There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

About the Company:

Incorporated in 1988 ASK Automotive specializes in manufacturing advanced braking systems and precision-engineered components for two-wheelers. The company’s product portfolio includes:

· Advanced Braking Systems (ABS): Offering a variety of braking components like brake panel assembly, brake shoes, and disc brake pads suited for motorcycles, scooters, and other vehicle segments.

· Aluminium Lightweight Precision Solutions (ALPS): Producing engine parts, body and chassis components, and transmission parts for both internal combustion engine vehicles and electric vehicles.

· Wheel Assembly: This provides complete wheel solutions to OEMs, catering to a diverse range of two-wheelers.

· Safety Control Cables (SCC): Manufacturing crucial control cables including throttle, brake, and clutch cables necessary for vehicle safety and functionality.

The company operates 15 manufacturing facilities in India, catering to a wide market that includes major Original Equipment Manufacturers like Honda Motorcycle and Scooter India, Hero MotoCorp, Suzuki, TVS, Yamaha, and Bajaj, while also serving aftermarket needs and exporting globally.

The bifurcation of the revenue can be observed in the below table:

Industrial Overview:

Despite the slowdown in near term, India is expected to remain a growth outperformer over the medium run. CRISIL MI&A expects GDP growth to average 6.1% between Fiscal 2025 and Fiscal 2027, compared with 3.1% globally as estimated by IMF.

The two-wheeler (“2W”) segment dominates the Indian auto industry (approximately 76% by volumes) and primarily dictates its tone. The industry saw a decline of 4.3% CAGR (between Fiscal 2018 to Fiscal 2023) in total 2W sales along with a marginal CAGR in the PVs and commercial vehicles (“CVs”) segments. This decline was owing to a slowdown in the economy, transition to BS VI norms, and the challenges posed by the COVID-19 pandemic in Fiscal 2022. The below graph captures the expected growth rate of production volume.

IPO Objectives:

The company will not receive any proceeds from the Offer and all the Offer Proceeds will be received by the Selling Shareholders, in proportion to the Offered Shares sold by the respective Selling Shareholders as part of the Offer.

Financials

The Company’s revenue from operations increased from Rs. 1543.99 crores in FY 2020-21 to Rs. 2,555.17 crores in FY 2022-23 indicating a CAGR growth of 28.64%.

The company's EBITDA expanded from Rs. 210.11 Crores in FY 2020-21 to Rs. 247.55 Crores in FY 2022-23, with a CAGR of 8.54%. However, the company’s EBITDA margin has declined from 13.61% in FY 2020-21 to 9.69% in FY 2022-23.

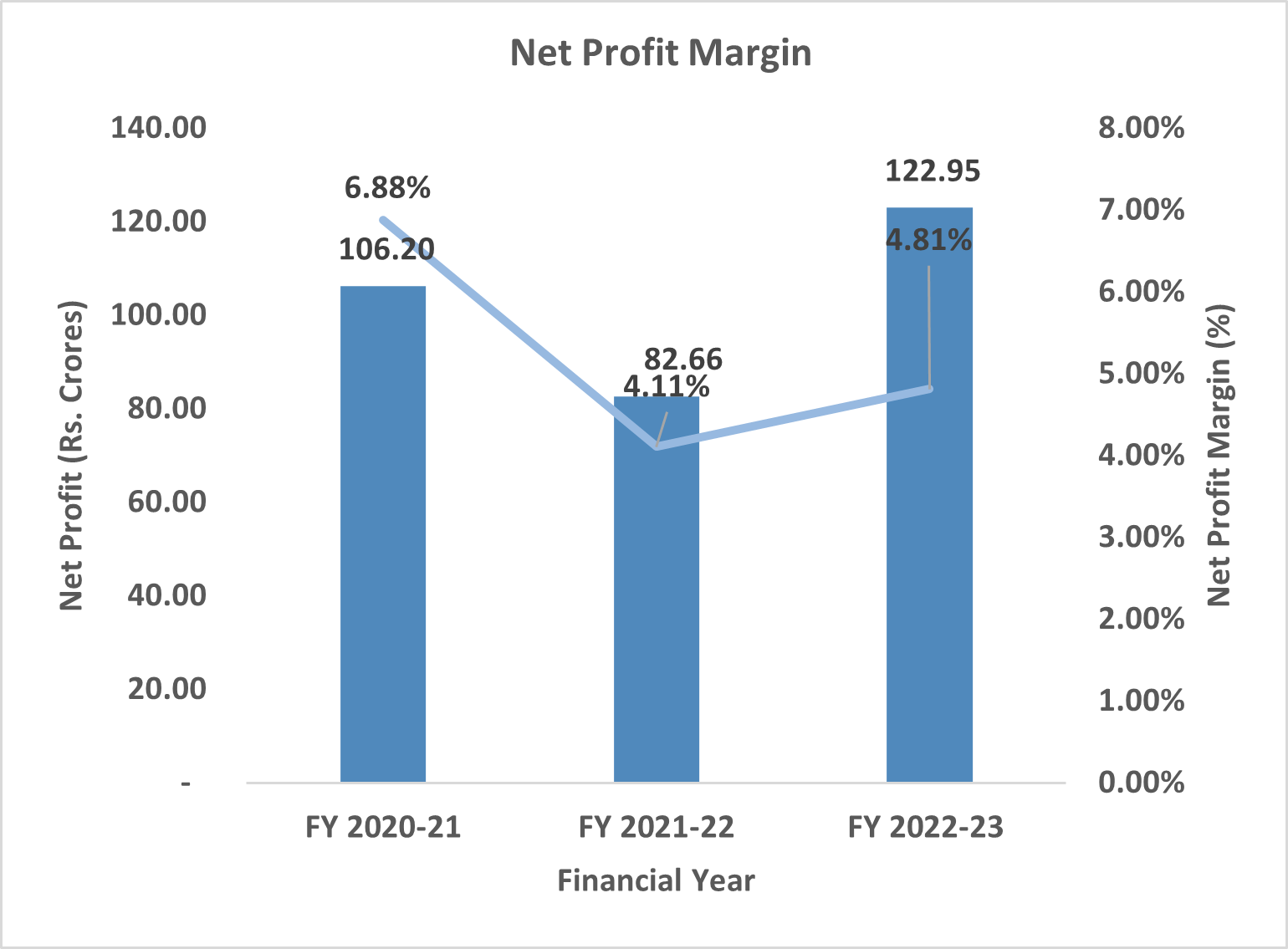

The company's Net Profit expanded from Rs. 106.20 Crores in FY 2020-21 to Rs. 122.95 Crores in FY 2022-23, with a CAGR of 7.60%. However, the company’s Net Profit margin has declined from 6.88% in FY 2020-21 to 4.81% in FY 2022-23.

The company's ROCE has slightly improved from 21.98% in FY 2020-21 to 22.06% in FY 2022-23, however the same slipped to the levels of 16.76% in FY 2021-22.

The ROE has increased from FY 2020-21 to FY 2022-23 being 17.00% in FY 2020-21 to 19.27% in FY 2022-23, however the same slipped to the levels of 13.33% in FY 2021-22.

Valuation:

The company's price-to-earnings ratio stands at 45.63, while the industry's PE ratio is 58.33, suggesting that the issue price is fairly valued. Additionally, the company's price-to-book ratio is 8.63, whereas the industry's PB ratio is 6.37, signifying over valuation of the issue price.

Peer Comparison

Key Risks:

1. Offer for Sale: The company will not receive any proceeds from the Offer for Sale, as it is a sale by existing shareholders.

2. Two-Wheeler Sector Dependence The company’s revenue is highly reliant on the Indian two-wheeler automotive sector, which makes it vulnerable to sector-specific downturns.

3. Customer Concentration Risk With over half of its revenue coming from the top three customers, the loss of any key customer could significantly affect the financial health of the company.

4. Raw Material Volatility The company’s profitability hinges on the cost and availability of raw materials like Aluminium, with no guaranteed supply agreements, making it susceptible to market volatility.

IPO Details