There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

About the Company

Concord Biotech Limited is an Indian Biopharma company established on 7th November 2001 in Ahmedabad.

The company manufactures:-

1. bio-pharmaceutical APIs through fermentation and semi-synthetic processes, across the therapeutic areas of immunosuppressants, oncology, and anti-infectives; and

2. formulations, which are used in the therapeutic areas of immunosuppressants, nephrology drugs, and anti-infective drugs for critical care.

APIs are active pharmaceutical ingredients that have effects such as preventing or curing diseases. Formulations refer to drug products that are used by patients, such as tablets, capsules, or injections. Immunosuppressants are drugs that are typically used by patients undergoing organ transplants, as these drugs suppress the immunity of the patient such that the body accepts the transplanted organ. Further, immunosuppressants are also used for the treatment of autoimmune disorders. Anti-infectives are medicines that prevent or treat infections and include anti-bacterial and anti-fungal medications. Oncology and nephrology drugs are used in the treatment of cancers and kidney conditions respectively. Additionally, the company also offers contract research and manufacturing service, where it collaborates with third-party pharmaceutical companies to develop APIs and Formulations. However, this segment contributed only 0.02% to the revenue from operations of the company in FY 2022-23.

As of June 30, 2023, the company has a portfolio of 57 brands and 76 products manufactured by it, including 23 APIs and 53 formulations. In addition, as of March 31, 2023, the company has 80 out-licensed formulations which it distributes in India under its brands. For the FY 2022-23 approximately 89.23% of the revenue from operations was derived from the sale of APIs, whereas the balance 10.77% was derived from the sale of formulations.

Concord Biotech supplies to more than 70 countries including regulated markets, such as the United States, Europe, and Japan. For the FY 2022-23 the company earned 50.65% of its revenue from India, 17.26% from the United States, and 32.09% from the Rest of the world marking its global presence.

The company has three manufacturing facilities at Dholka, Valthera, and Limbasi and two dedicated research and development units (“R&D”) at Dholka and Valthera in the state of Gujarat. The manufacturing facilities at Dholka and Limbasi manufacture APIs and the one at Valthera manufactures Formulations.

Industry Overview

Growing populations and increasing life expectancies have led to aging populations with greater healthcare needs and pharmaceutical consumption due to factors such as the increased prevalence of chronic illnesses.

According to the United Nations, the global number of people aged 65 years and above is expected to double in 30 years, increasing faster than younger age groups globally, and is projected to constitute 16.5% of the total population in 2050 compared to 8.7% in 2017.

The impact of an aging population is higher in countries such as Japan and member states of the European Union (EU), where the population aged above 65 accounts for approximately 30% of the total population.

Economic prosperity is linked to urbanization to some extent. According to the World Bank, in 2022, nearly 57% of the world's population lived in cities, up from 55% in 2017. By 2050, with the urban population more than doubling its current size, nearly seven out of every ten people will live in cities.

However, urbanization also brings healthcare challenges such as pollution-related respiratory problems, sedentary lifestyle-related chronic diseases, and high population density-associated infectious disease spread, leading to increased healthcare and pharmaceutical expenditure.

Global pharmaceutical spending grew from $ 1,138 billion (Rs. 81,074 billion) in 2019 to $ 1,333 billion (Rs. 110,315 billion) in 2022 at a CAGR of 5.4%.

The domestic healthcare market is also growing rapidly and is projected to grow at a CAGR of 8% to 10% from 2023 to 2026 because of more willingness to spend on healthcare and government policies like the Ayushman Bharat Program, the Ayushman Bharat Health Infrastructure Mission, and the Pradhan Mantri Bhartiya Janaushadi Pariyojana.

Further, India is a crucial supplier of generic drugs, providing almost 40% of the total U.S. generic drug demand and 25% of the total drug demand in the United Kingdom.

The global API market was valued at approximately $219 billion (Rs.18,157 billion) in 2022 and is expected to reach approximately $278 billion (Rs. 23,051 billion) by the year 2026, at a projected CAGR of 6.1% over the forecast period of 2022 to 2026 and the Indian API market was valued at $17 billion (Rs.1,377 billion) in 2022 and is expected to grow at a CAGR of 11.1% between 2022 and 2026.

IPO Objectives

1. To achieve the benefits of listing the Equity Shares on the Stock Exchanges.

2. Carry out the Offer for Sale of up to 20,925,652 Equity Shares by the Selling Shareholders.

Financials

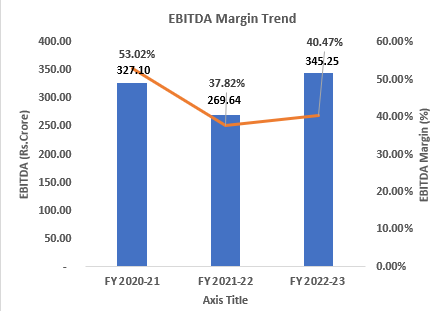

The company's revenue from operations witnessed a CAGR of 17.59% from FY 2020-21 to FY 2022-23. During the same period, EBITDA and Net Profit experienced a meager growth of 2.74% and 1.09% respectively. Further, both the EBITDA Margin and Net Profit Margin are showing a declining trend and the ROCE and ROE are also on a downward trajectory.

Valuation

Based on earnings, the issue price can be considered slightly undervalued because the PE ratio of the company~32.29 is less than that of the industry~35.97. Whereas, based on book value, the issue price can be considered slightly overvalued because the PB ratio of the company~6.01 is more than the PB ratio of the industry~5.27.

Peer Comparison

The overall position of the company looks good in comparison to its peers.

Key Risks

1. A significant portion of the revenue is derived from a single product viz., immunosuppressant API. A decline in the sale of this product may adversely affect the business of the company. For FY 2022-23, 89.23% of revenue was derived from this product.

2. The company is dependent on a limited number of customers for a substantial portion of its revenue. 33.47% of the total revenue from operations is earned from the top five customers, while 44.28% of the total revenue from operations is earned from the top ten customers. Any significant reduction in demand from these customers may adversely affect the business of the company.

3. For FY 2022-23, 49.22% of the raw material was purchased from the three largest suppliers and 81.45% of the raw material was purchased from the ten largest suppliers implying dependence on a few vendors for raw materials. Any delay, interruption, or reduction in the supply of raw materials may hurt the business.

4. The company has three manufacturing facilities and two dedicated research and development (“R&D”) units, which are all located in Gujarat, India. A shutdown in Gujarat may adversely affect the business of the company.

IPO Details

1. The IPO is scheduled to take place from the 4th of August 2023 to the 8th of August 2023.

2. The price band for the IPO ranges from Rs.705 to Rs.741.

3. The total issue size for the IPO is Rs.1,551 crores, entirely Offer for Sale.

4. To participate in the IPO, the minimum application required is for 1 lot, which comprises 20 shares and is worth Rs.14,820.

5. The maximum application size allowed for retail investors in this IPO is 13 lots, totaling 260 shares and worth Rs.192,660.

6. As of the time of writing this blog, the Grey Market Premium stands at 25.64%.