There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

About the Company:

Incorporated in 2006, DOMS Industries Limited is engaged in designing, developing, manufacturing, and selling a wide range of stationery and art products, primarily under their flagship brand ‘DOMS’, in the domestic market as well as in over 45 countries internationally, as of September 30, 2023

The categories in which the company operates are:

· Scholastic stationery

· Scholastic Art Material

· Paper stationery

· Kits and Combos

· Office Supplies

· Hobby and Craft

· Fine Art Products

Which contributed to the revenue from operations for FY 2022-23 as follows:

The company is the 2nd largest player in India’s branded ‘stationery and art’ products market, with a market share of 12% (value) as of FY 2022-23. Core products ‘pencils’ and ‘mathematical instrument boxes’ enjoy high market shares; 29% and 30% market share by value in FY 2022-23 respectively. Out of the total revenue from operations for FY 2022-23, 79% was earned domestically and 21% was earned from exports. The registered office of the company is at Valsad, Gujarat and manufacturing facilities are at Umbergaon, Gujarat, and Bari Brahma, Jammu and Kashmir.

Industry Overview

The stationery and art materials industry deals in a wide range of products & categories, comprising paper products, writing instruments, computer stationery, school stationery, office stationery, stationery adhesives and art & craft products among others. The global market was valued at approximately $ 192 billion in CY 22 and is expected to reach a market size of $ 220 billion by CY 27, registering a CAGR of approximately 2.8% during the forecasted period, as compared to 2.0% from CY 16 to CY 22.

The Indian stationery and art materials market has exhibited continuous growth over the years. It has an estimated size of Rs. 38,500 Crores by value as of FY 2022-23. However, the market witnessed a substantial sales dip in FY 2020-21 due to COVID-19, during which schools and colleges were closed and shifted to online mode of education and offices also went into work-from-home mode. The market bounced back with 35% growth in FY 2021-22 due to a revival in demand post the reopening of schools, and colleges, and the resumption of work from office. The Indian stationery and art materials market is expected to grow at a CAGR of ~13% during FY 2022-23 to FY 2027-28 period to reach a market value of Rs. 71,600 Crores by FY 2027-28.

IPO Objectives:

1. Proposing to partly finance the cost of establishing a new manufacturing facility to expand its production capabilities for a wide range of writing instruments, watercolour pens, markers, and highlighters.

2. General corporate purposes.

Financials

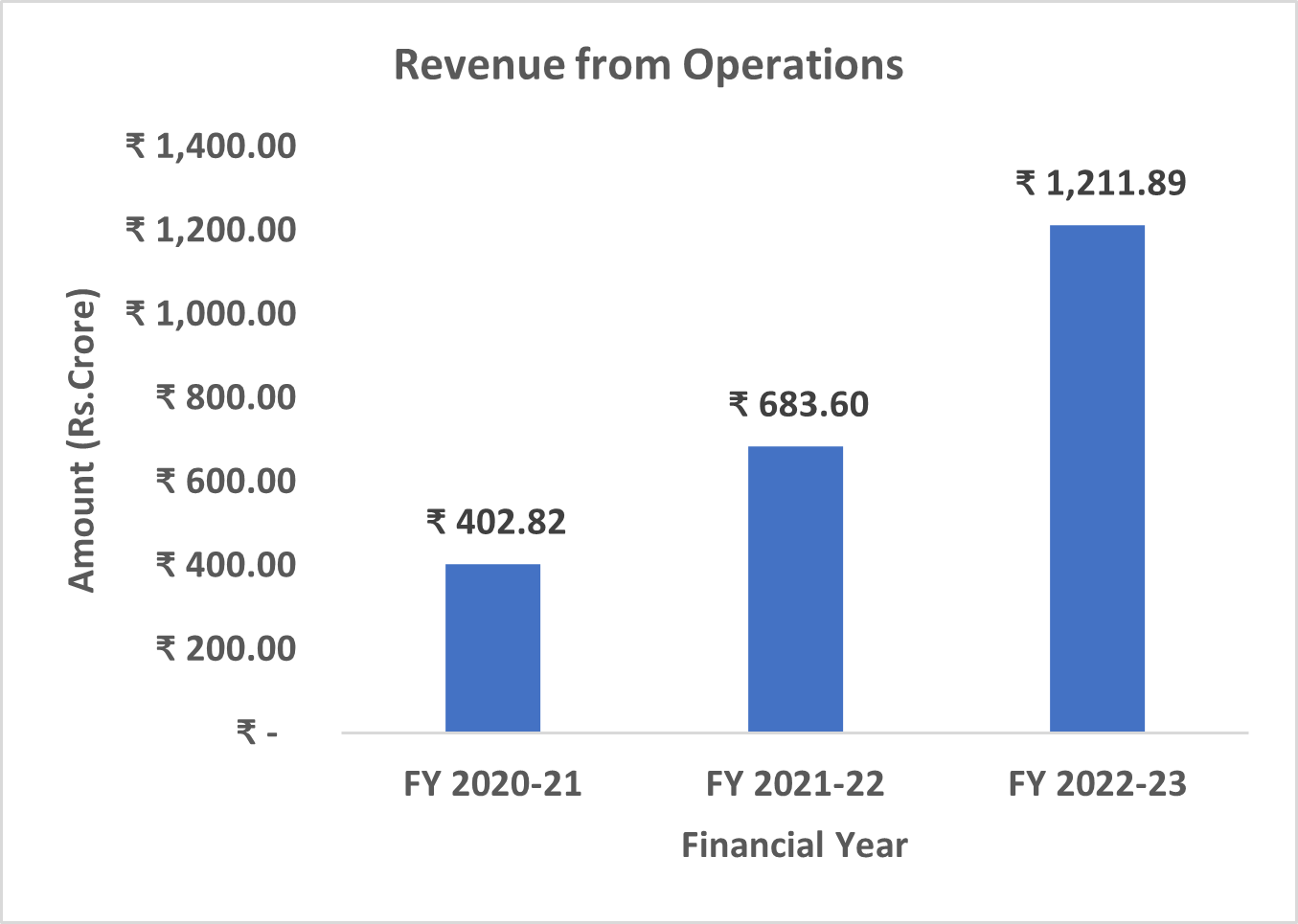

The Company’s revenue from operations increased from Rs. 402.82 crores in FY 2020-21 to Rs. 1211.89 crores in FY 2022-23 indicating a CAGR growth of 73.45%.The company's EBITDA expanded from Rs. 30.03 Crores in FY 2020-21 to Rs.186.66 Crores in FY 2022-23, with a CAGR of 149.34%. Also, the company’s EBITDA margin has increased from 7.45% in FY 2020-21 to 15.40% in FY 2022-23. The company's Net Profit expanded from Rs. (6.03) Crores in FY 2020-21 to Rs. 102.87 Crores in FY 2022-23. Also, the company’s Net Profit margin has increased from -1.50% in FY 2020-21 to 8.49% in FY 2022-23. The company's ROCE has improved from 0.36% in FY 2020-21 to 33.31% in FY 2022-23. The ROE has increased from FY 2020-21 to FY 2022-23 being Nil in FY 2020-21 to 33.54% in FY 2022-23.

Valuation:

The company's price-to-earnings ratio stands at 43.19, while the industry's PE ratio is 35.98. Additionally, the company's price-to-book ratio is 13.17, whereas the industry's PB ratio is 6.10.

Peer Comparison

From the above table, we can see that DOMS Industries Limited is at par with its listed peers.

Key Risks:

1. The company derived a significant portion amounting to 59.54% of the Gross Product Sales in FY 2022-23 from the sale of key products and a significant portion amounting to 31.66% in FY 2022-23 from the sale of wooden pencils. Any decline in the Gross Product Sales of key products in general or specifically ‘wooden pencils’ could harm the business, results of operations and financial condition of the company.

2. The company faces significant competitive pressures in the business from listed peers, unlisted peers, and counterfeit products. Any inability to compete effectively would have a material adverse effect on the business, prospects, operations, or financial results of the company.

3. For FY 2022-23, The company had negative cash flows from investing activity of Rs. 135.93 crores and negative cash flow financing activity of Rs. 12.37 crores and it may continue to have negative cash flows in the future, which could adversely affect the liquidity and operations of the company.

4. The operations of the company are human capital intensive and may be materially adversely affected by strikes, work stoppages or increased wage demands by the employees of the company.

5. The company is dependent on its promoters the FILA group for its export sales. For FY 2022-23, 61.58% of the export sale was accounted to the FILA group. In the event FILA ceases to be a Promoter, it may affect the business operations and adversely impact the R&D and export capabilities. Further, any damage to the reputation of the FILA Group may adversely affect the business, results of operations and financial condition of the company.

IPO Details