EaseMyTrip is an Online Travel Agency (OTA), founded in 2008. It is one of the leading OTAs in India. It was ranked 2nd in terms of booking volume in the nine months ended December 31, 2020, and 3rd in terms of gross booking revenues in Fiscal 2020 amongst key OTAs in India. The company holds a market share of approx. 4.6% in Fiscal 2020.

The products and services offered by the company are organized primarily in the 3 segments: (i) airline tickets (ii) hotels and holiday packages, and (iii) other services, which consists of rail tickets, bus tickets, taxi rentals, and ancillary value-added services such as travel insurance, visa processing and tickets for activities and attractions.

They have the largest network of 59,274 Travel agents across India. The Company operates via 3 distinct distribution channels- B2C, B2E, and B2B2C and reaches their customers via their website, app, and travel agents registered with them. Mr. Nishant Pitti, Mr. Rikant Pittie, and Mr. Prashant Pitti are the company promoters. As of December 31, 2020, they had 349 full-time employees.

Have a look at their Journey

Industry Analysis:

The tourism industry accounted for 10.3% of the global GDP in 2019, however, COVID- 19 had an adverse impact on it. As per the World Travel and Tourism Council’s (WTTC) report, international tourist arrivals could decline by 60% to 80% in 2020 with a loss of $3.4 trillion in global GDP.

India’s tourism spending recorded a CAGR of 5.8% from 2014 to 2019, driven by rising incomes and improved availability and affordability of travel. The government has allowed 100% FDI for the development of hotels, resorts, recreational facilities, city, and regional-level infrastructure. According to WTTC, India’s spending on tourism grew at a CAGR of 5.4% between 2013-19. However, due to COVID-19, the Indian travel industry is expected to plunge at a CAGR of 2% from Fiscal 2020 to Fiscal 2023. Yet, there are hopes that the industry will be driven by pent-up demand, tourism infrastructure development, rising spending on travel and tourism, and reforms in visa and passports.

Competitive Strengths:- The company has been 100% bootstrapped i.e. It did not require any equity infusion since inception and have managed their growth entirely through internal accruals.

- The company is the only profitable player in the last 3 financial years amongst peers based on Net profit Margin.

- The company has a consistent track record of financial and operational performance with lean and cost-efficient operations

- The company has an in-house advanced technology infrastructure that enables them to manage its product and service offerings and improve operating efficiencies. The company has an 85.95% repeat transaction rate between April 1st, 2017 to December 31st, 2020, which is a positive sign. Their mobile traffic increased from 65.18% in FY18 to 87.15% for 9 months period ending December 31st, 2020.

- The outbreak of COVID-19 led to travel restrictions and lockdowns globally, hence the company’s Gross booking revenues have decreased from ₹ 31,798.04 million in the nine months ended December 31, 2019, to ₹ 12,207.57 million in the nine months ended December 31, 2020.

- The company is dependent on the airline ticketing business, which accounted for 94% of revenue in Fiscal 2020. This is derived from a limited number of airline suppliers in India.

- Under the airline ticketing business, revenue is primarily generated from commissions and incentive payments from travel suppliers. Any reduction or elimination in such commissions and incentive payments from suppliers may impact the company’s Gross Booking Volumes adversely.

- A rise in the prices of travel elements can adversely affect the company’s operation, turnover, and profitability.

- The Company has limited experience and operating history in hotels and holiday packages, and railway ticketing operations which can impact future growth aspects of the company.

Financials:The company has experienced revenue growth at a CAGR of 25.80% between Fiscal 2018-20. In Fiscal 2020, the air passage segment contributed 94%, hotel packages contributed 5.4%, and other services contributed 0.6% of their total revenue. For FY20, approx. 93% of the airline tickets Gross Booking Volume was from Domestic air travel and balance from International air travel.

In FY20, PAT margin stood at 24.57% and EBITDA margin was 103.57%. PAT has grown at a CAGR of 128.90%, and EBITDA has grown at a CAGR of 22.28% between Fiscal 2018-20. During the same period, Company’s net cash flow from operating activities grew at a CAGR of 93.33%. The company’s Gearing ratio (ratio which measures the degree to which firms operations are funded by equity capital vs debt financing – lowers the better) has reduced to 38.86% as of December 31st,2020 from 72.12% as of March 31st, 2018.

The Company does not have any listed industry peers in India.

Litigations:MakeMyTrip (India) Private Limited has alleged that EaseMyTrip has used terms and phrases in their Google AdWords program which are deceptively similar to their registered trademarks in the word ‘MakeMyTrip’, logos, and websites making it an Infringing Activity. The matter is currently pending. The Company has few cases where they are liable to their Travel Agents due to violation of agreements, inadequately recorded sales, and refunds, however, the company has filed counter cases and the matter is still pending.

The company has filed several criminal proceedings against their ex-employees for dishonest misappropriation of property, criminal breach of trust, misappropriating funds, etc which are still pending. FIR has been filed against Mr. Nishant Pitti under the IPC, where he was asked to appear before the Mahila Court. The matter is currently pending.

Future Plans of the Company:

The Company plans to sustain high growth in Air Travel, focus on expanding its Hotel and Holiday packages segment, and leverage its strong travel agents’ network to reach out to more customers and procure and on-board local hotels especially in Tier II and Tier Ill cities.

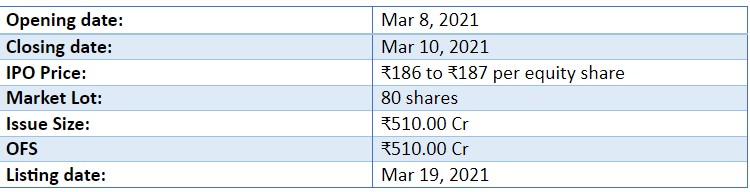

IPO details:

It is a 100% OFS (offer for sale), no fresh issue. Therefore, the IPO proceeds will not go to the company. An object of the issue: With 10.32 million registered customers, the company now wants to achieve share listing benefits.