There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

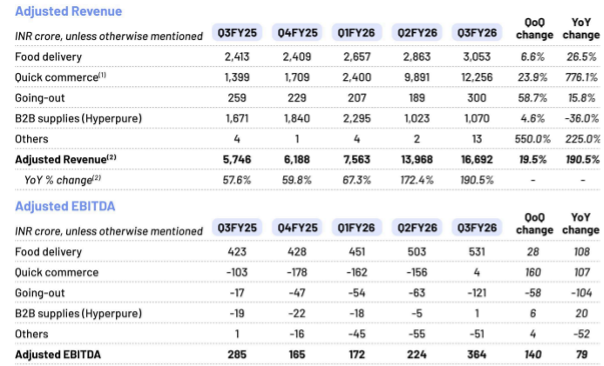

In this blog, we focus on some important details of Eternal’s Q3 results for FY26.Today, despite a strong financial performance, the stock corrected by almost 10% from its day high. Eternal’s Q3 FY26 results mark an important milestone in the company’s journey, reflecting rapid scale-up across food delivery, quick commerce, and supply chain businesses.

Strong Financial performance(Direction matters more than speed):

Net Profit of the company was ₹102 crore in Q3, which is up by 73% YoY (₹59 crore in Q3 FY25).

Revenue from Operations grew to ₹16,315 crore, which was a 200% YoY increase on a consolidated basis.

Adjusted EBITDA was ₹364 crore, which was 28% YoY growth.

Key Growth Drivers:

Rapid revenue expansion across core businesses: food delivery (Zomato), quick commerce (Blinkit), and supply chain (Hyperpure).

Quick commerce (Blinkit) contributed significantly, with strong Net Order Value (NOV) growth and EBITDA turning positive.

Expenses:

Total expenses jumped sharply with business scaling, reflecting inventory costs, delivery costs, and marketing spend increases

Segment Performance Highlights:

Food delivery Adjusted EBITDA reached an all-time high margin of 5.4% of NOV(Net Order Value) with INR 531 cr profit. Hyperpure turned marginally profitable, while the going-out business NOV grew 20%.HYPERPURE grew 33% YoY and Adjusted EBITDA turned positive.

Quick commerce business and Store Expansion:

BLINKIT achieved EBITDA breakeven for the first time. Quick commerce NOV remained strong at 121% YoY (14% QoQ) with like-for-like growth of 130%+ YoY. The company added 211 net new stores (now 2,027), slightly below guidance of 2,100 stores.The company remains on track for a target of 3000 stores by March 2027.

Leadership and Strategic Shift:

Deepinder Goyal, founder and Group CEO, stepped down effective Feb 1, 2026.

Albinder Singh Dhindsa (CEO of Blinkit) appointed a new Group CEO.

Goyal transitions to Vice Chairman, focusing on long-term strategy.

Investor Metrics & Trends:

Major year-over-year improvements in key metrics signal operational scaling, especially in quick commerce and food delivery.

Strong cash position despite heavy investments:

Eternal ended Q3FY26 with a cash balance of ₹17,820 crore, compared to ₹18,314 crore in the previous quarter. The decline was attributed to planned investments in store expansion, inventory, and working capital, particularly in quick commerce, rather than operational weakness.