There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Introduction:

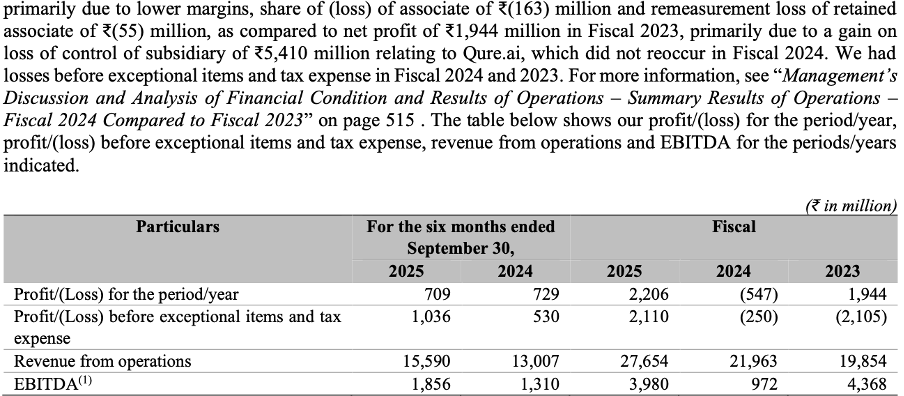

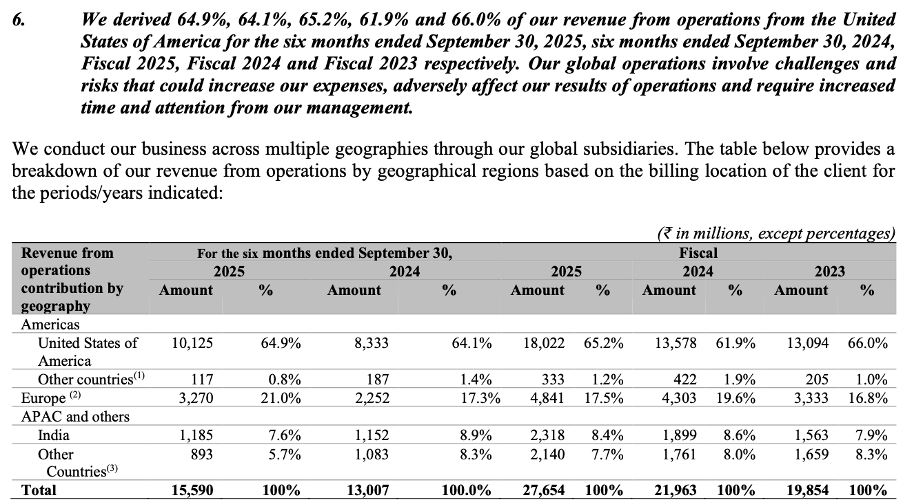

Fractal Analytics Limited, formerly known as Fractal Communications Limited, is India’s leading pure-play enterprise data analytics and Artificial Intelligence (AI) company, founded in the year 2000. Headquartered in Mumbai, the company has over 25 years of global operating history and works as a trusted AI partner for large global enterprises, including several Fortune 500 companies. Fractal was co-founded by Srikanth Velamakanni (Whole-time Director and Group CEO) and Pranay Agrawal (Non-executive Director and CEO - Fractal USA), who have led the company since inception. As of September 2025, Fractal operates through 24 offices across nine countries, including the US, UK, and Australia.

What does Fractal Analytics do?

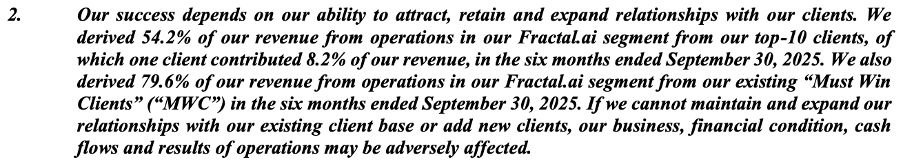

Fractal Analytics helps large enterprises make better business decisions using data, analytics, and AI. Instead of selling traditional software, Fractal embeds AI systems into client operations to support decision-making across areas such as customer behaviour analysis, pricing, marketing effectiveness, supply chain optimisation, product launches, and operational efficiency. The company primarily serves large global enterprises, referred to as “Must Win Clients” (MWCs), defined as companies with annual revenue above USD 10 billion, market capitalisation above USD 20 billion, or a customer base exceeding 30 million. As of September 30, 2025, Fractal served 122 such MWCs.

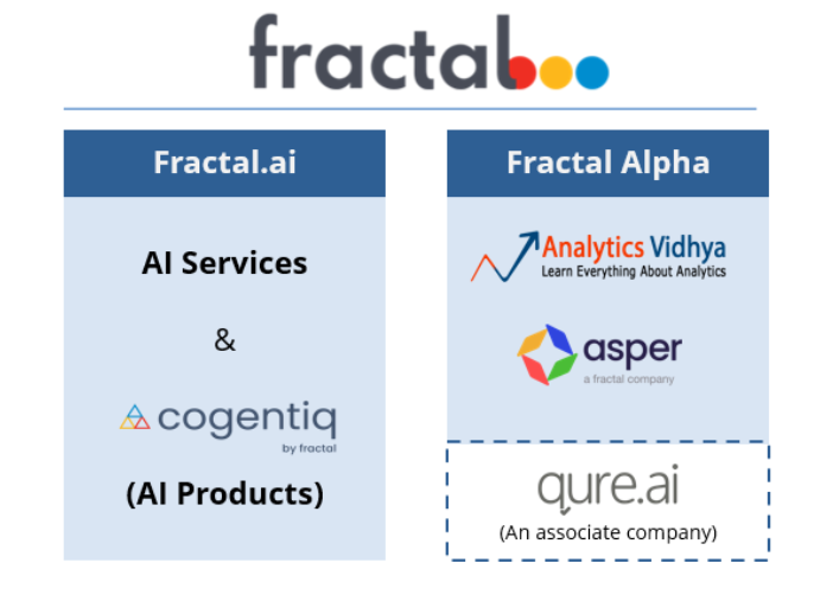

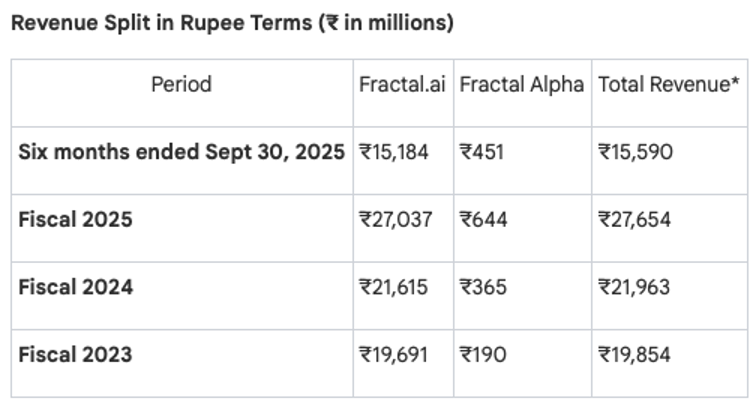

Business Segments

Fractal operates through two main segments:

Fractal.ai

This is the core business segment, comprising AI services and AI products. Fractal provides long-term AI-driven consulting and implementation services to enterprises, supported by its proprietary agentic AI platform, Cogentiq. Cogentiq works in the background, enabling faster deployment, governance, and scalability of AI solutions. Clients pay for ongoing AI-powered decision support rather than one-time software purchases.

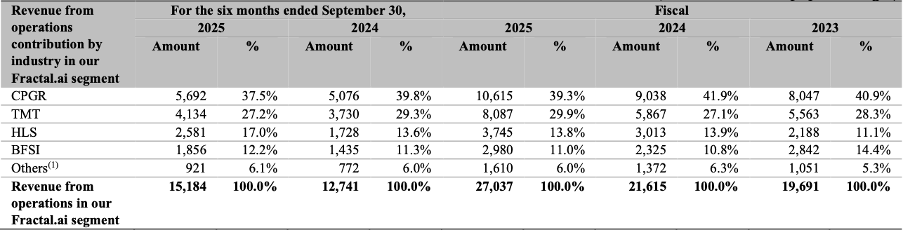

This diversified industry exposure reduces dependency on any single sector while allowing deep domain expertise across verticals.

This diversified industry exposure reduces dependency on any single sector while allowing deep domain expertise across verticals.