There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

About the Company:

Established as a partnership firm in 1999 and subsequently incorporated as a company in 2009 They are a fastmoving consumer goods company in India, offering ethnic snacks, western snacks and other products in ten States and two Union Territories as of September 30, 2023.

Company offers a wide variety of savoury products under our brand ‘Gopal’, including ethnic snacks such as namkeen and gathiya, western snacks such as wafers, extruded snacks and snack pellets, along with fast-moving consumer goods that include papad, spices, gram flour or besan, noodles, rusk and soan papdi.

Images of the products for better understanding: -

Company operates six manufacturing facilities comprising three primary manufacturing facilities and three ancillary manufacturing facilities.

Three primary manufacturing facilities are located at -

1. Nagpur, Maharashtra;

2. Rajkot, Gujarat; and

3. Modasa, Gujarat

These facilities primarily focus on the manufacturing of finished products. Three ancillary manufacturing facilities primarily focus on producing besan or gram flour, raw snack pellets, seasoning and spices which are primarily used for captive consumption in the manufacturing of finished products such as gathiya, namkeen and snack pellets.

Of the three ancillary manufacturing facilities, two ancillary manufacturing facilities are located at Rajkot, Gujarat and one ancillary manufacturing facility is located at Modasa, Gujarat.

As of September 30, 2023, the aggregate annual installed capacity of six manufacturing facilities was 404,728.76 MT, of which the aggregate annual installed capacity of three primary manufacturing facilities (including the annual installed capacity for papad which is manufactured at one of the ancillary manufacturing facilities located in Rajkot, Gujarat) was 303,668.76 MT and the aggregate annual installed capacity of three ancillary manufacturing facilities (excluding the annual installed capacity for papad) was 101,060.00 MT. The table below sets forth the details with respect to the capacity utilisation of our primary and ancillary manufacturing facilities:

Industrial Overview:

· As per the F&S Report, the Indian market for savoury snacks which includes western snacks and ethnic savouries or traditional snacks (including gathiya), is estimated to be valued at ₹ 796 billion in Fiscal 2023, of which western snacks and ethnic savouries (including gathiya) were estimated to be valued at ₹ 409 billion and ₹ 388 billion, contributing 51% and 49% of the overall Indian savoury snacks market, respectively (Source: F&S Report).

· The Indian market for savoury snacks is projected to grow at a CAGR of approximately 11% reaching ₹ 1,217 billion by Fiscal 2027 (Source: F&S Report). Further, the organized market is estimated to hold a market share of approximately 57% in Fiscal 2023 in the Indian market for savoury snacks and is forecasted to grow at a CAGR of 11.7% during Fiscal 2023 to 2027, accounting for a market share of approximately 58% by Fiscal 2027.

· The below graphs represent the market growth of the organised Indian ethnic namkeen and snacks market, organised western snack market and organised gathiya market in India:

IPO Objectives:

Company will not receive any proceeds from the Offer (the “Offer Proceeds”) and all the Offer Proceeds will be received by the Selling Shareholders net of the Offer expenses.

Financials:

The Company’s revenue from operations increased from Rs. 1128.86 crores in FY 2020-21 to Rs. 1394.65 crores in FY 2022-23

The company's EBITDA expanded from Rs. 60.35 Crores in FY 2020-21 to Rs. 196.23 Crores in FY 2022-23

The Company’s net profit has expanded from 21.12 Cr in FY 2020-21 to 112.37 Crores in FY 2022-23

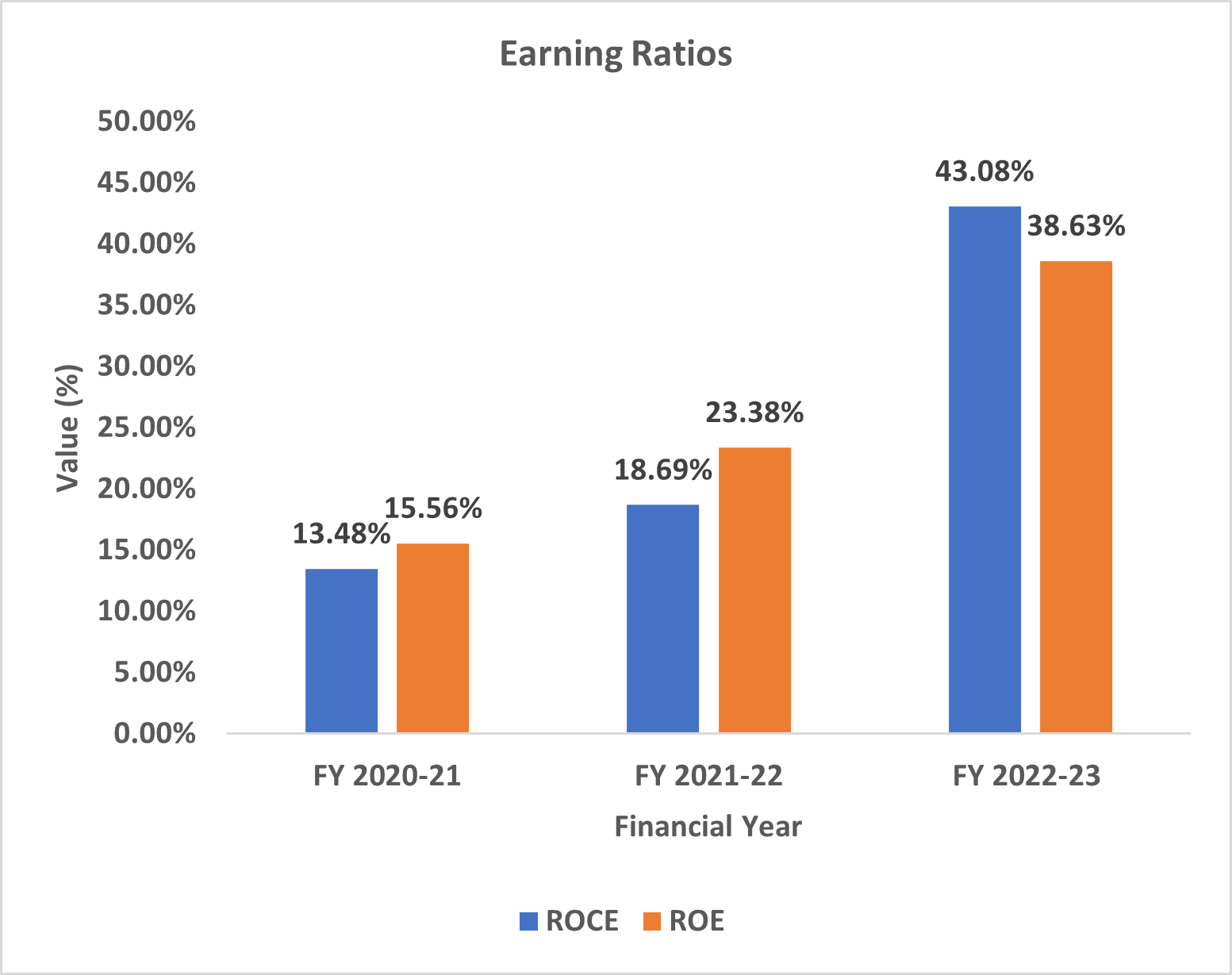

The Company’s ROCE is improved from 13.48% in FY 2020-21 to 43.08% in FY 2022-23.

The ROE has been ranging from FY 2020-21 to FY 2022-23 being 15.56% in FY 2020-21 to 38.63% in FY 2022-23.

Valuation:

The company's price-to-earnings ratio stands at 44.46, while the industry's PE ratio is 121.27.

Peer Comparison:

Key Risks:

1. The sale of products is concentrated in core market of Gujarat. In Fiscal 2021, 2022 and 2023 and the six months ended September 30, 2022 and 2023, Company’s revenue from sale of products in Gujarat accounted for 74.31%, 76.27%, 79.08%, 79.06% and 76.49% of revenue from operations, respectively.

2. The Offer comprises an Offer for Sale aggregating up to ₹6,500 million and Company will not receive any proceeds from the Offer.

3. Company is significantly dependent on the sale of their products namely, namkeen, gathiya and snack pellets. Their aggregate revenue from sale of namkeen, gathiya and snack pellets accounted for 88.96%, 85.25%, 81.66%, 83.24% and 77.89% of their revenue from operations in Fiscal 2021, 2022, 2023 and the six months ended September 30, 2022 and 2023, respectively.

IPO Details: