There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

History and Comparison:

In the last 2 decades, the global economy faced 2 major crises which had a severe impact on the capital market. One was in 2008, The most severe financial crisis since the great depression and another which currently the entire world is facing i.e. health crisis due to COVID-19 which impacted the global economy severely. 2008 was triggered by the collapse of the housing bubble in the U.S., the crisis resulted in the collapse of Lehman Brothers (one of the biggest investment banks in the world), brought many key financial institutions and businesses to the brink of collapse, and required government bailouts of unprecedented proportions. It took almost a decade for things to return to normal, wiping away millions of jobs and billions of dollars of income along the way.

We have never had a global recession or market meltdown triggered by a public health crisis in modern history. Recent recessions and market meltdowns were triggered by economic/financial causes. But now, we have a market meltdown triggered by a global pandemic.

In 2008, Nifty crashed 65% from the peak; but that was spread over several months. This time a 30 percent crash happened within a few days. In the mother market US, Dow crashed 32 percent in 18 days.

Based on a study published by “Atlantic Council” - below are the similarities and difference between 2008 and 2020 crisis:

Based on a study published by “Atlantic Council” - below are the similarities and difference between 2008 and 2020 crisis: Similarities:

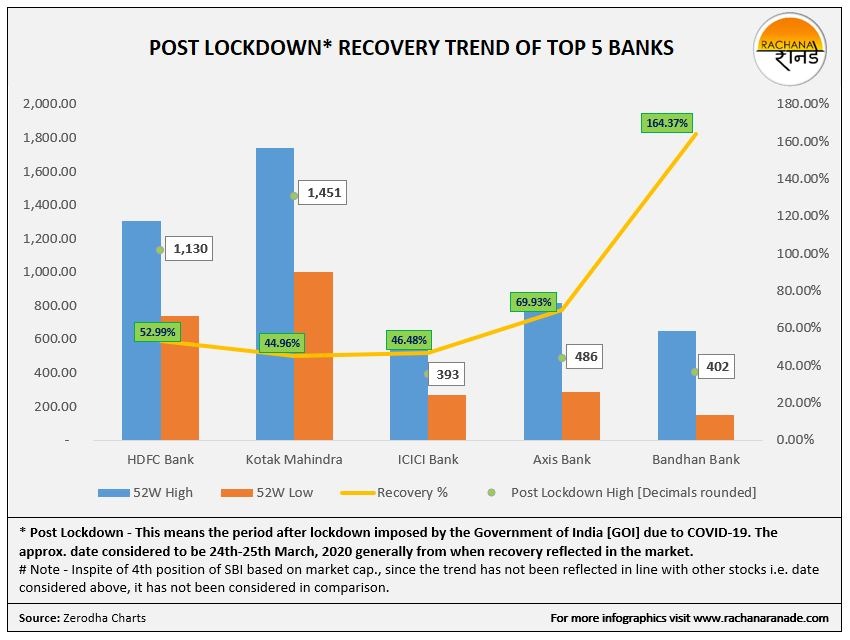

Based on the above infographic we can see how the top 5 banks recovered and the extent of recovery based on policies of the banks and governmental support. In such a pandemic period, if the stock of the company is recovering at a significant pace compared to peers, then one should always study the factors behind that. Because fundamentally strong and high CAGR from future perspectives and vision of the companies reflects in such situations to a certain extent.

Based on this understanding, one question definitely arises in the mind, what are the factors specifically impacted that Bandhan Bank recovered at the rate of 164.37% compared to the top 4 banks recovered in the range of 44-70%. Study at your end and let us know your views over this.