There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

About the Company:

Incorporated in 1998, the company is a NBFC with retail focused affordable housing finance company with a distribution network comprising 203 branches spread across 15 states with a significant presence in the states of Rajasthan, Maharashtra, Madhya Pradesh, Karnataka and Gujarat as of September 30, 2023. The company’s target segment is the self-employed customer with a focus on first time home loan takers in the low- and middle-income group in Tier II and Tier III cities in India, and affordable housing loans i.e., loans with ticket size lower than ₹2.5 million.

The key financial and operational information of the company is indicated in the below table:

To understand the customer profile of the company, let us have a look at the AUM based on occupation & income category of the customers:

Details of product-wise disbursements of the company is as under:

The company’s financing profile is captured in the below table:

To understand the geographical concentration, let us have a look at the major states where the AUM of the company is concentrated:

Industry Analysis:

Over the past three Financial Years, Indian economy has outperformed its global counterparts by witnessing a faster growth. Going forward as well, IMF projects that Indian economy will remain strong and would continue to be one of the fastest growing economies.

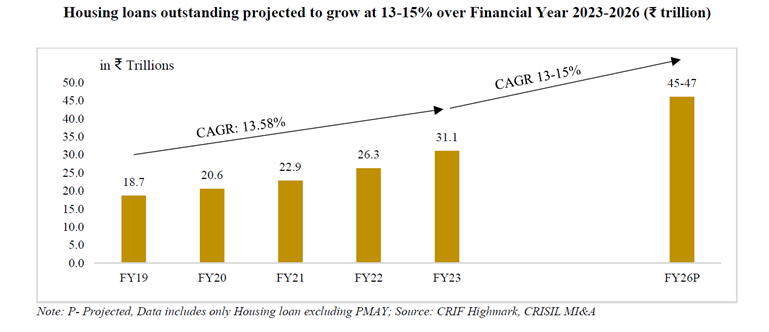

Overall, between Fiscal 2023 to Fiscal 2025, CRISIL MI&A forecasts NBFC credit to grow at a CAGR of 12%-14%. Further, retail credit given out by NBFCs is forecast to grow at a pace of 13%-15% CAGR over the same time.

IPO Objectives:

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

1. To meet future capital requirements towards onward lending, and

2. General corporate purposes.

Financials:

The Total Income has grown from 322.80 crores in FY 2020-21 to 606.23 crores in FY 2022-23 showing a CAGR growth of ~37%.

The profitability has increased from 87.39 crores in FY 2020-21 to 155.34 crores in FY 2022-23 showing a CAGR growth of ~33%. The profit margins have remained at a similar level between 26% & 28%.

The NPA numbers have also sweetened as we can see a fall in Gross NPA as well in Net NPA.

Valuation:

The company's price-to-earnings ratio stands at 28.22, while the industry's average PE ratio is 31.67.

Additionally, the company's price-to-book ratio is 3.49, whereas the industry's PB ratio is 4.23.

Peer Comparison:

Key Risks:

1. Risk of default by borrowers

The company primarily serves customers in the low and middle-income strata in India

2. Geographical Concentration

A major proportion of the AUM is concentrated in three states (Rajasthan, Maharashtra & Madhya Pradesh) which contributed to ₹32,506.14 million or 62.7%. of the total AUM.

3. Extensive Regulation

The Indian housing finance industry is extensively regulated and any changes in laws and regulations applicable to housing finance companies could have an adverse effect on our business.

IPO Details