There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

About the Company:

IREDA is a Government of India enterprise under the administrative control of the Ministry of New and Renewable Energy (MNRE). The Company was incorporated in Delhi on March 11, 1987, as "Indian Renewable Energy Development Agency Limited," and soon started its business. It achieved recognition as a public financial institution in 1995 and obtained a non-banking financial institution registration from the Reserve Bank of India on January 23, 2008. The company's business scope evolved, culminating in its reclassification as an infrastructure finance company on March 13, 2023, from its initial classification as an investment and credit company. Currently, IREDA is a “Public Financial Institution”, registered as a Systemically Important Non-Deposit taking Non-Banking Financial Company (“NBFC-ND-SI”), with Infrastructure Finance Company (“IFC”) status.

The company has also been granted a “Mini-Ratna” (Category-I) status by MNRE in the year 2015. IREDA is the largest pure-play green financing NBFC in India. As per RBI, “green finance” means lending to and / or investing in the activities/projects that contribute to climate risk mitigation, climate adaptation and resilience, and other climate-related or environmental objectives

Business of the Company:

IREDA is a seasoned financial institution with over 36 years of expertise in the industry. The Company specializes in the business of promoting, developing, and extending financial assistance for new and renewable energy (“RE”) projects, and energy efficiency and conservation (“EEC”) projects. Their financial support spans project inception to post-commissioning, covering diverse sectors such as solar, wind, hydropower, biomass, waste-to-energy, and emerging technologies like biofuel and green hydrogen. As of September 30, 2023, the company holds a substantial portfolio of Term Loans Outstanding, amounting to ₹47,514.48 crores.

The array of financial products offered by IREDA includes fund-based options like long-term, medium-term, and short-term loans, supporting RE developers and manufacturers. Non-fund-based products, including letters of comfort and payment on order instruments, contribute to the company's comprehensive offerings. The company also provides line of credit to other NBFCs for on-lending to RE and EEC projects. In addition to these, IREDA provides loans to government entities.

Beyond financing, IREDA extends its influence by providing consulting services on techno-commercial issues related to the RE sector. Actively participating in significant schemes launched by the Ministry of New and Renewable Energy (MNRE), IREDA plays a vital role in advancing India's renewable energy landscape.

The information provided on the Term Loans Outstanding below offers a glimpse into the company's sectoral diversification in lending:

The below table captures the type of borrower the company is lending to:

Industrial Overview:

India ranks as the world's third-largest energy producer and second-largest consumer. the nation has witnessed a consistent rise in demand, with peak energy demand growing at a CAGR of 4.7% from 148 GW in Fiscal 2014 to 216 GW in Fiscal 2023, while peak supply grew at a CAGR of 5.3% over the same period. The energy demand and supply is expected to see growth at a CAGR of 4.5% or more till 2027. From 2027 onwards it is expected to grow at even greater CAGR.

As on September 2023, renewable sources amount to 42% of the total installed capacity. Fuelled by government initiatives, including a commitment to achieve India's climate targets, the installed renewable power capacity is projected to rise to 336 GW by Fiscal 2027, with solar, wind, and hydro contributing 55%, 22%, and 16%, respectively. By Fiscal 2032, the RE capacity is expected to reach 595 GW, comprising 66% of the total power generation capacity. In fact, the total potential of renewable power in India is estimated to be 1,639 GW. This growth is supported by the abundant availability of resources, lower tariffs, and technological advancements in renewable power. A total outlay of ₹ 24.43 trillion is expected towards renewable capacity additions between Fiscal 2023 - Fiscal 2032.

The government is actively promoting emission reduction through initiatives such as the National Green Hydrogen Mission, allocating ₹190 billion to establish India as a global hub for green hydrogen. With targets like 30% electric vehicle adoption by 2030 and 46,397 public charging stations, the government is driving the expansion of EV infrastructure. In tandem, major industries are implementing decarbonization measures to contribute to the net-zero target by 2070. This governmental focus on renewable energy presents lending opportunities for power-focused non-banking financial companies (NBFCs).

IREDA stands as a prominent non-banking financial company (NBFC) in this sector. The table below provides insights into the distribution of this specific industry segment among various NBFCs:

IPO Objectives:

The company's primary objectives for utilizing the net proceeds are to bolster the capital base for future capital requirements and lending activities. Additionally, the company anticipates various advantages from listing Equity Shares on Stock Exchanges and establishing a public market for Equity Shares in India.

Financials

Valuation:

The company's price-to-earnings ratio stands at 8.47, while the industry's average PE ratio is 6.79, suggesting that the issue price is overvalued. Additionally, the company's price-to-book ratio is 1.23, whereas the industry's PB ratio is 1.17, signifying an overvaluation of the issue price.

Peer Comparison

Key Risks:

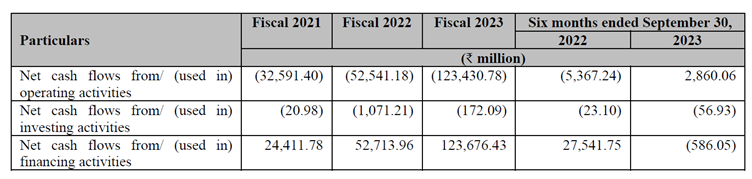

· Negative Cashflow Uncertainty:

The company currently faces negative cash flow from operations, and there is no assurance that such negative cash flows will not recur in the future.

· Customer Concentration Risk:

The company's loan portfolio is concentrated among certain customers, and any deterioration in the financial conditions of these customers could significantly and adversely impact the asset quality, financial condition, and operational results.

· Legal Proceedings Impact:

The company is currently subject to statutory proceedings under the Prevention of Money Laundering Act, 2002. There are also some other outstanding litigations of the company. Any adverse outcomes in these proceedings in the future could have a detrimental impact on the recovery of specific loans extended by the Company.

· Auditor Qualifications:

The auditor has given emphasis of matter on certain issues, one of the prominent issues is as under:

‘The Company has classified certain accounts required to be classified as stage III /Non-Performing Assets (NPA) as stage II / Standard aggregating to ₹8,931.29 million in terms of interim order of Hon’ble High Court of Andhra Pradesh.’

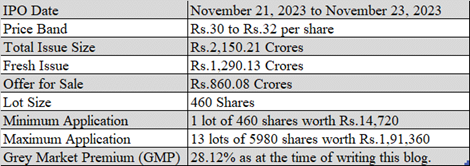

IPO Details