There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

About the company

Manoj Vaibhav Gems N Jewellers Limited is a prominent jewellery brand in the Andhra Pradesh and Telangana regions and is led by its founder and first-generation female entrepreneur, Mrs. Bharata Mallika Ratna Kumari Grandhi, who is also the Promoter, Chairperson and Managing director of the company. Further, she is joined by her daughter, Grandhi Sai Keerthana, who is a Chartered Accountant by qualification and a Promoter, Whole-time Director, and Chief Financial Officer (CFO) of the company.

The company sells a wide range of gold, silver, and diamond jewellery, precious gemstones, and other jewellery products to meet the needs of all types of customers.

The contribution of different products to the revenue from operations for FY 2022-23 is:-

The company has 13 showrooms (inclusive of two franchisee showrooms) across 8 towns and 2 cities in Andhra Pradesh & Telangana.

Industry Overview

India ranks fifth in the world in terms of nominal gross domestic product (GDP) and is the third largest economy in the world in terms of purchasing power parity (PPP). India is estimated to be among the top three global economies in terms of nominal GDP by FY 2049-50. India has been the fastest-growing G20 economy since FY 2014-15, with annual growth rate hovering around 7%. India’s GDP grew at 9.5% in FY 2021-22 and at 6.8% in FY 2022-23.

The global jewellery market is estimated at $340.7 billion in CY 2022 and is a significant contributor to the world economy. Diamond and gold are two precious items contributing more than 50% of the global jewellery market. USA, China, and India are the top three markets in the global jewellery market with different pecking order in diamond and gold jewellery market.

The Indian jewellery retail sector’s size in FY 2022-23 was close to $ 70 billion. The sector’s organized retail share stood at approximately 32%, comprised of national and regional players, while the rest of jewellery retail continues to be dominated by the unorganised segment, comprised of over 500,000 local goldsmiths and jewellers.

The jewellery retail market is expected to grow to approximately $ 124 billion by FY 2026-27 on account of the growing economy and rising disposable income, increasing consumer demand for gold, growth in gold prices and rising demand for other categories like diamonds, other precious stones, and costume jewellery.

Consumer demand for major markets in gold consisting of jewellery demand and demand for gold coins and bars has now reached an estimated volume of 3,328 tones. India and China are the top two players in the market. Other top three markets are USA, Germany, and Turkey. It is estimated that he top five markets contributed 70% of the total market in 2022.

Demand for gold in the jewellery segment was close to 2,086 tons in CY 2022 compared to 2,124 tons in CY 2021. India is the market leader with a share of close to 29% followed by China contributing 27% in calendar year 2022. India and China together contribute 56% of gold consumption towards jewellery with top five markets contributing 67% of the total jewellery demand in 2022.

IPO Objectives

1. To finance the proposed establishment of 8 new showrooms.

2. General corporate purposes.

Financials

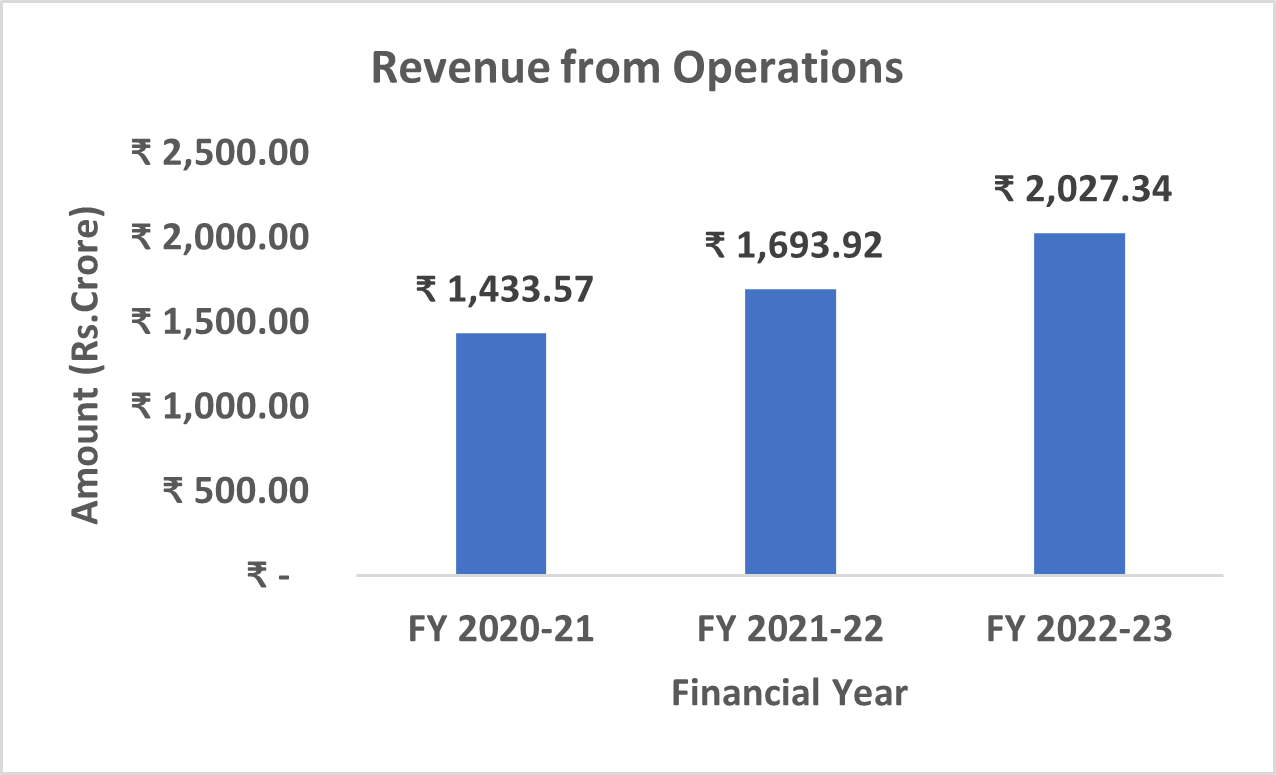

The company's revenue saw a substantial rise, progressing from Rs. 1433.57 crores in FY 2020-21 to Rs. 2027.34 crores in FY 2022-23, exhibiting a CAGR of 18.92%. Simultaneously, the company witnessed an enhancement in its EBITDA, which escalated from Rs. 69.55 crores in FY 2020-21 to Rs. 143.06 crores in FY 2022-23, demonstrating a CAGR of 43.42%. The Net Profit also experienced a notable surge, ascending from Rs. 20.74 crores in FY 2020-21 to Rs. 71.60 crores in FY 2022-23.

Furthermore, the company's operational performance improved with an increase in the EBITDA Margin, which rose from 4.85% in FY 2020-21 to 7.06% in FY 2022-23. Similarly, the Net Profit Margin exhibited an upward trajectory, climbing from 1.45% in FY 2020-21 to 3.53% in FY 2022-23. The company's ROCE showed significant improvement, advancing from 10.54% in FY 2020-21 to 17.71% in FY 2022-23, and the ROE also saw a substantial boost, surging from 9.49% in FY 2020-21 to 23.19% in FY 2022-23.

Valuation

The company's PE Ratio stands at 11.74, while the Industry's PE Ratio is at 51.65. Consequently, this suggests that the issue price is underestimated. Similarly, the company's PB Ratio is 2.44, in contrast to the Industry's PB Ratio of 10.15, once again pointing towards an undervalued issue price.

Peer Comparison

Titan holds the top position in India's gems and jewellery sector across all performance indicators. Despite Manoj Vaibhav Gems N Jewellers Limited having the lowest revenue from operations, its EPS and NAV per share outperform Kalyan Jewellers Limited and Tribhovandas Bhimji Zaveri Limited. Furthermore, the company's Profit Margins, ROE, and ROCE appear to be in line with its publicly listed counterparts.

Key Risks

1. The showrooms of the company are spread across states of Andhra Pradesh and Telangana only. The net proceeds of the Offer will also be utilised by the Company to expand its presence across the state of Andhra Pradesh and Telangana only by setting up of proposed 8 new showrooms. Any change in political scenario, change in economic condition, natural calamity, etc. in the states of Andhra Pradesh and Telangana may have a negative impact on our business, sales, and results of operations.

2. The Company, Promoters and Directors are involved in certain legal proceedings and potential litigation and it has not made any provision in the financial statements for such liabilities. Any adverse decision in such proceedings may render it liable to liabilities/penalties and may adversely affect the business of the company.

3. The markets in which the company operates are highly competitive. The competitors of the company include both organised pan-India jewellers as well as unorganized local players. Any increase in the competition may adversely affect the business and financial condition of the company.

4. Gold is the primary raw material used by the company. For FY 2022-23, the cost of goods sold was 86.95% of the revenue from operations. Therefore, the non-availability or high cost of quality gold bullion, silver, diamonds, and other precious and semi-precious stones may have an adverse effect on our business, results of operations and financial condition of the company.

5. The company procures gold which is the main raw material, through Banks and authorised bullion dealers. Any fluctuations in the price of gold may influence the business, results of operations and financial condition of the company. The other raw materials used viz., silver, platinum, diamonds, and precious stones are also subject to price fluctuations.

6. There are certain instances of non-compliances and alleged non-compliances with respect to certain regulatory filings for corporate actions taken by the Company in the past. Consequently, the company may be subject to regulatory actions and penalties for any such past or future non-compliance and the business, financial condition and reputation may be adversely affected.

IPO Details