There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

About the Company

Incorporated on 22nd September 1999, ‘Netweb Technologies India Limited’ is one of India’s leading high-end computing solutions-provider, with fully integrated design and manufacturing capabilities. The company offers:

1. High performance (Supercomputing/HPC) systems;

2. Private cloud and hyperconverged infrastructure (HCI);

3 .AI systems and enterprise workstations;

4. High performance storage (HPS/Enterprise Storage System) solutions;

5. Data centre servers; and

6. Software and services for HCS offerings.

Netweb Technologies India Limited caters to marquee Customers across various end-user industries such as information technology, information technology enabled services, entertainment and media, banking, financial services and insurance (BFSI), national data centres and government entities in the defence sector and education and research development institutions (Application Industries).

The company is the largest manufacturer of Supercomputers in India. It has India’s fastest and largest AI supercomputing system. It manufactures and provides customised high-capacity AI based workstations to marquee education systems in India like IITs which are used for scientific activities, 3D designs and animations, engineering designs etc. The company also manufactures customised solutions for numerous sectors like Higher Education and Research, Space and Defence, IT and ITES, etc. The company also designs and innovates products and provide services tailored to specific customer requirements in collaboration with Intel Americas, Inc. (Intel), Advanced Micro Devices, Inc. (AMD), Samsung India Electronics Private Limited, and Nvidia Corporation (Nvidia).

Products and Offerings of the Company:

Revenue contribution of numerous business verticals

Industry Overview

The global IT Industry was estimated to $ 4,817 Billion in FY 2022. The market is forecasted to be $ 5,156 Billion in FY 2023 and is forecasted to reach $ 7,846 Billion by FY 2029 with a CAGR of 7.2% over the forecast period (FY2023-2029).

The Indian IT Industry market was $ 201,000 Million in FY 2022. The market is forecasted to be $ 225,000 Million in FY 2023 and is forecasted to reach $ 372,706 Million by FY 2029 with a CAGR of 8.8% over the forecast period (FY2023-2029).

A stable economy, the expansion of e-commerce, the upgrade of mobile networks to 4G and 5G, and the implementation of "Make in India" and PLI Schemes are some of the elements that will contribute to the expansion of the IT industry in India.

The Indian IT market is segmented into Telecom Services, Emerging Tech, IT + Business Services, Software, Other Devices + Infrastructure, Workstations, HPC Systems. The Indian IT industry is forecasted to grow at a CAGR of 8.8% for the period FY 2022-23 to FY 2028-29.

IPO Objectives

1) Funding capital expenditure requirements for:

a. Civil construction of the building for the surface mount technology (SMT) line and interior development; and

a. Purchase of equipment/machineries for new SMT production line (SMT Line);

2) Funding the long-term working capital requirement.

3) Repayment or pre-payment, in full or in part, of certain outstanding borrowings; and

4) General corporate purposes

Financials

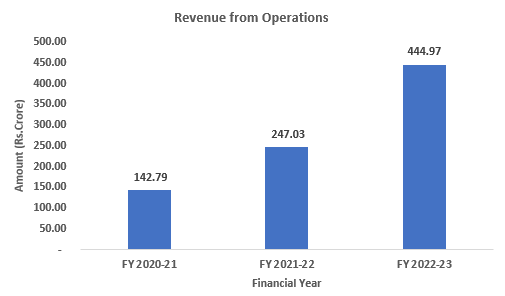

The Revenue of the company has grown at CAGR of 76.53% over the period of 3 years from FY 2020-21 to FY 2022-23. The EBITDA and Net Profit, grew at a CAGR of 110.92% and 138.82% respectively during the same period. The EBITDA and Net Profit margins have also improved over the period under review. Improvement can be seen in ROE and ROCE also.

Valuation

The price-to-earnings ratio (PE) of the company stands at 55.13, while the PE of the industry is 79.82, indicating undervaluation. However, the price-to-book ratio (PB) of the company is 27.18, whereas the PB of the industry is 11.53, indicating overvaluation.

Key Risks

1. The company is heavily reliant on its top 10 customers for revenue. The share of top 10 customers in the company’s revenue from operations increased from 52.26% in FY 2020-21 to 57.80% in FY 2022-23.

2. The company derives the majority of revenue from Supercomputing systems and Private Cloud & HCI segments. The combined revenue from the two segments was 38.11% in FY 2020-21 and it increased to 72.32% in FY 2022-23. In FY 2021-22, the company changed its focus from HPS Solutions to Supercomputing Systems.

3. Cost of Raw Materials consumed is a significant expenditure of the company. In FY 2022-23, the cost of raw materials consumed was 73.09% of the revenue from operations and 86.74% of the total operating costs.

IPO Details

1. The IPO is scheduled to take place from the 17th of July 2023 to the 19th of July 2023.

2. The price band for the IPO ranges from Rs.475 to Rs.500.

3. The total issue size for the IPO is Rs.631 crores, consisting of a fresh issue of Rs.206 crores and an Offer for Sale of Rs.425 crores.

4. To participate in the IPO, the minimum application required is for 1 lot, which comprises 30 shares and is worth Rs.15,000.

5. The maximum application size allowed for retail investors in this IPO is 13 lots, totalling to 390 shares and worth Rs.195,000.

6. As of the time of writing this blog, the Grey Market Premium stands at 73%.