There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

About the Company:

Incorporated in 1995, Protean eGov Technologies Limited, previously known as NSDL e-Governance Infrastructure Limited is one of the key IT-enabled solutions companies in India engaged in conceptualizing, developing, and executing nationally critical and population-scale greenfield technology solutions.

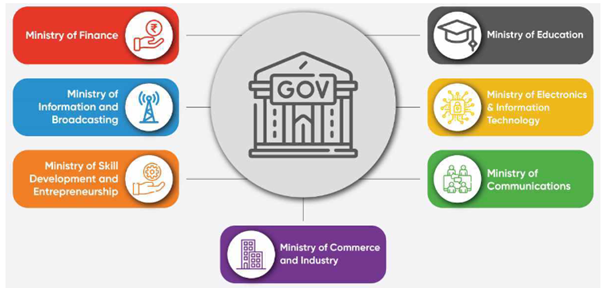

They were originally set up as a depository in 1995 and created a systemically important national infrastructure for capital market development in India. It has been the chief architect and implementer for some of the most critical and large-scale technology infrastructure projects in India. Since inception and as of June 30, 2023, the company has implemented and managed 19 projects spread across seven ministries.

The company has established several public digital infrastructures and has created e-governance interventions impacting multiple sectors of the Indian economy like the following:

1. Modernising the direct tax infrastructure in India through projects like Permanent Account Number (PAN) issuance where company has 45% market share, the Tax Information Network (TIN) where company has 58% market share and Online Tax Accounting Systems (OLTAS).

2. Building the core IT infrastructure as a Central Recordkeeping Agency (CRA) for the National Pension System (NPS).

3. Enabling the universal social security system for all Indians, particularly the workers in the unorganized sector by creating technology infrastructure as a CRA for the Atal Pension Yojana (APY)

4. Contributing to the India Stack, a set of application programming interfaces (“API”) that allows governments, businesses, startups, and developers to utilize a unique digital infrastructure to prepare solutions that are presence-less, paperless and enable cashless service delivery.

5. Contributing to and supporting open digital building blocks such as Open Network for Digital Commerce (ONDC) for use-cases across sectors like e-commerce, mobility, healthcare, agriculture, and education.

Industry Overview:

The company is engaged in the building and maintaining of public governance facilities and the biggest customer of the company is the government. Accordingly, the prospects of the company will depend on how well the Indian economy is poised to perform. Also, few other factors which needs to be considered are internet subscribers in India which are increasing due to affordable mobile data plans which have supported data usage in India. Monthly average data usage was estimated ~12.3 GB/subscriber/month in Fiscal 2021, growing to 17.36 GB/subscriber/month by Fiscal 2023 on account of online learning and work from home.

IPO Objectives:

The company will not receive any proceeds from the Offer and all the Offer Proceeds will be received by the Selling Shareholders, in proportion to the Offered Shares sold by the respective Selling Shareholders as part of the Offer.

Financials

The Company’s revenue from operations increased from Rs. 603.14 crores in FY 2021 to Rs. 741.21 crores for FY 2023 indicating a CAGR growth of 10.93%.

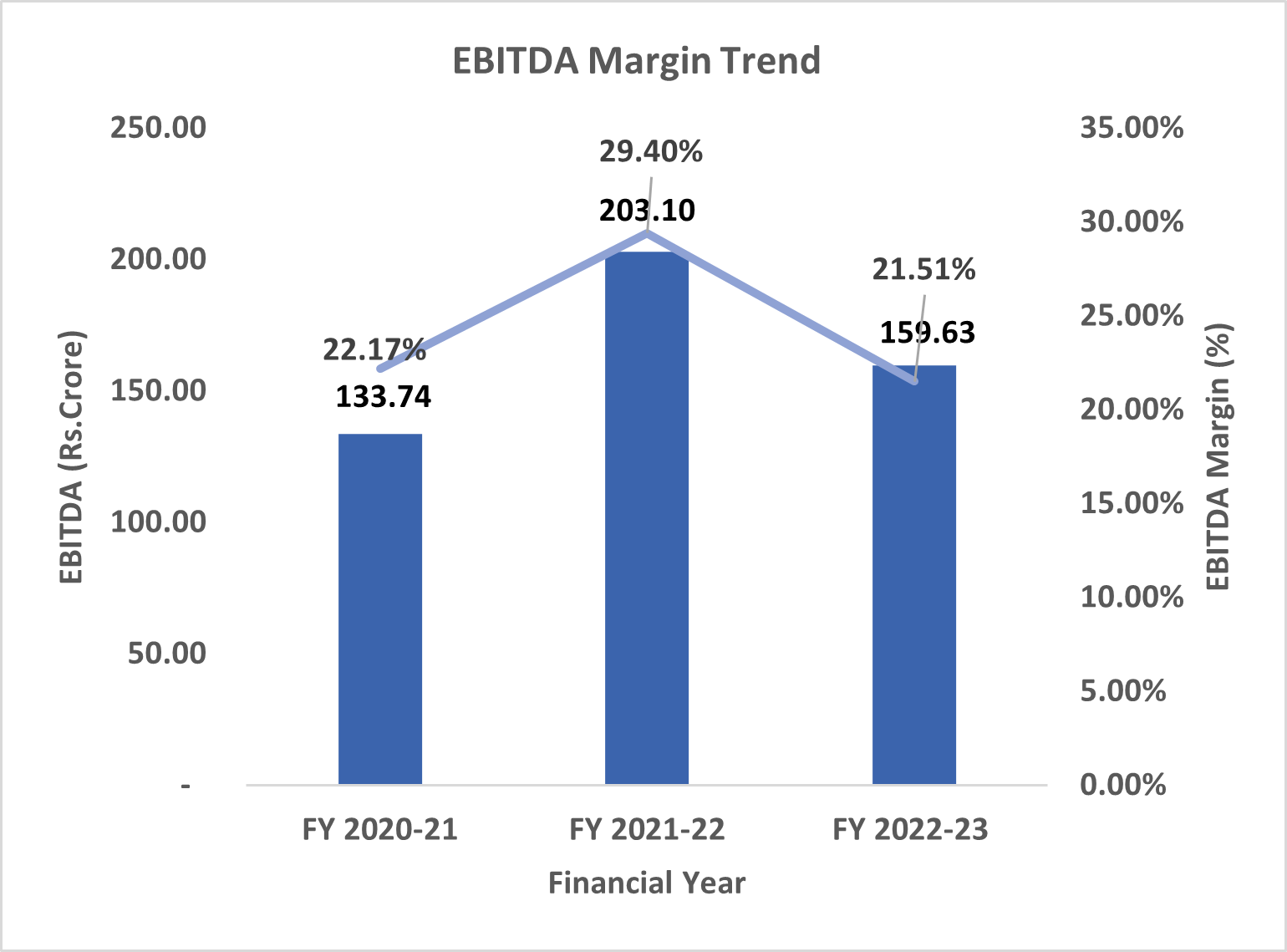

The company's EBITDA climbed from Rs. 133.74 crores in FY’21 to Rs. 203.10 crores in FY’22 to come back again at levels of Rs. 159.63 crores indicating a CAGR growth of 9.25%. The EBITDA margins have been in the range of 21% to 22% during FY 21 and FY 23, however it spiked during FY22 to 29.40%.

The company's Net Profit jumped from Rs. 92.19 crores in FY21 to Rs. 107.04 crores in FY 23 indicating a CAGR growth of 7.76%. The Net Profit margins have been in the range of 14% to 15% during FY 21 and FY 23, however it spiked during FY22 to ~21%.

The company's ROCE has been hovering around levels of 16% from FY 21 to FY 23. Similarly, the ROE has slightly dropped from 13.81% in FY21 to 12.49% in FY 23.

Valuation:

The company in its RHP states that there are no listed companies in India that are comparable in all aspects of business and services that the company provides. Hence, it is not possible to provide an industry comparison in relation to the Company.

On the higher price band of Rs. 792, the company demands a PE of 29.91x of the earnings of FY 23.

Key Risks:

1. Dependence on projects from Government entities

Nearly 73% of the revenues come from projects awarded by government entities and agencies and their relationship with GoI entities exposes them to risks inherent in doing business with them, which may adversely affect their business, results of operations and financial condition.

2. Higher receivables

Nearly 28% of the revenues are receivable by the company in FY2023. Any delay in the collection of the dues and receivables from their clients may have a material and adverse effect on the results of operations and cash flows.

3. Adoption & Development of new services

Business will suffer if we fail to anticipate and develop new services and enhance existing services in order to keep pace with rapid changes in technology and in the industries on which we focus.

4. Pending litigations against our Company

Certain legal proceedings involving the company are pending at different levels of adjudication before various courts, tribunals and authorities. In the event of adverse rulings in these proceedings or consequent levy of penalties, the company may need to make payments or make provisions for future payments to the tune of INR 179.29 crores

IPO Details