There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

A technology-led logistics backbone powering India’s digital commerce

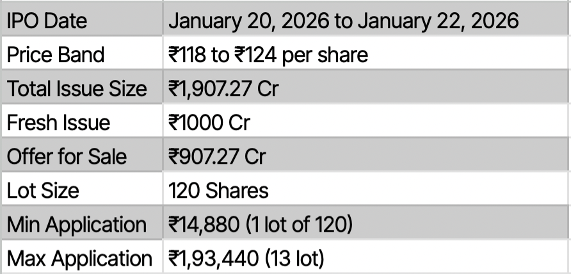

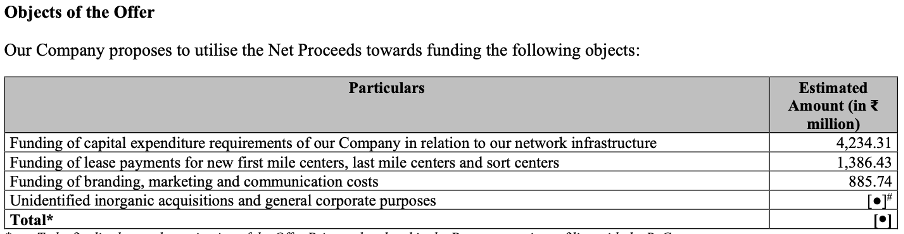

IPO Offer Details and Funds Utilisation,

Source: RHP, Shadowfax Technologies Ltd

Company Profile and Business Model

Shadowfax Technologies Limited is a technology led third party logistics provider enabling digital commerce across India through a large scale, asset light delivery network and proprietary technology. Incorporated in 2015 and converted into a public company in 2025, the business is promoted by its founders Abhishek Bansal and Vaibhav Khandelwal. Shadowfax has emerged as the fastest growing 3rd Party Logistics player of scale, expanding its e-commerce market share from about 8 percent in FY2022 to nearly 21 percent by June 2025, with leadership positions in quick commerce, reverse logistics, and same day delivery.

The company operates across express logistics, hyperlocal delivery, and specialised critical logistics, supported by India’s largest crowdsourced last mile fleet and a fully leased, asset light infrastructure. Its nationwide network spans over 14,700 pin codes and processed more than 436 million orders in FY2025. Proprietary technology systems power delivery partner management, route optimisation, fraud detection, and real time order allocation. Revenue is earned on a per order basis, with pricing linked to service type, distance, shipment weight, and delivery complexity.

Industry

India’s logistics market was valued at ₹21 to ₹23 trillion in FY2025 and is being reshaped by technology led players, a growing gig workforce expected to form about 4 percent of total employment by FY2030, and government initiatives such as Bharatmala, Gati Shakti, and the National Logistics Policy. E-commerce logistics handled 4.9 to 5.3 billion shipments in FY2025 and is expected to reach 15 to 16 billion shipments by FY2030, with third party logistics players catering to 40 to 42 percent of demand. Outsourcing is significantly higher among D2C and vertical platforms, while demand for same day delivery and reverse logistics continues to rise.

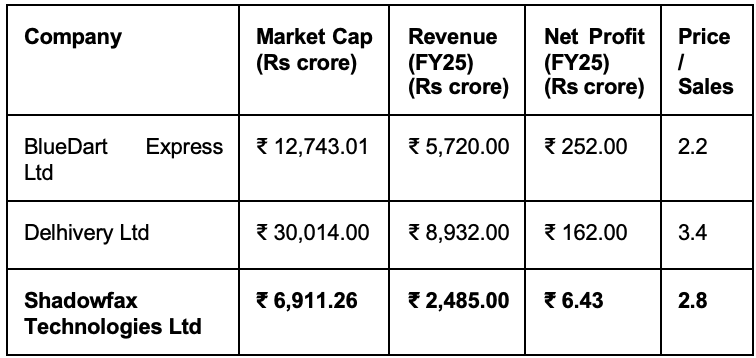

Quick commerce is the fastest growing segment, projected to grow at a 50 to 62 percent CAGR, supported by urban adoption and category expansion. The competitive landscape includes players such as Blue Dart, Delhivery, Shadowfax, and Xpressbees, with Shadowfax emerging as the fastest growing 3PL player of scale and a leader in quick commerce, reverse pick ups, and same day delivery. Despite strong growth drivers, the industry continues to face challenges related to infrastructure constraints, gig workforce management, and sustained margin pressure from competition.

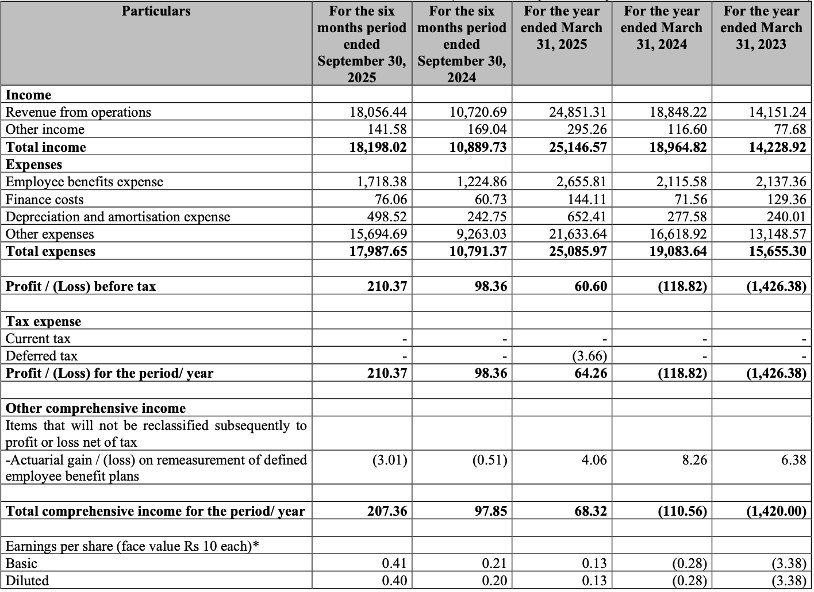

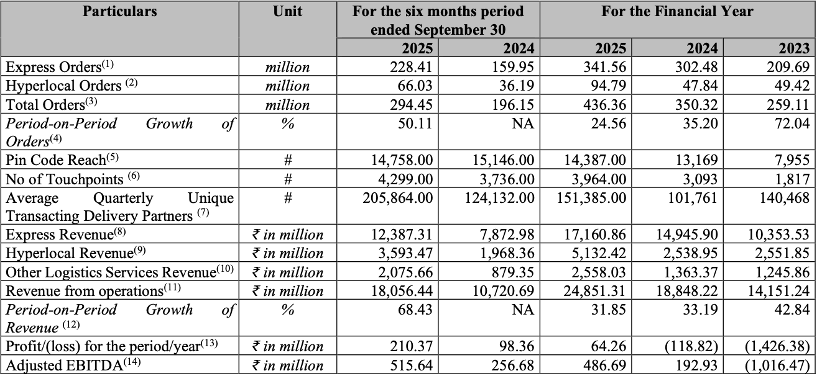

Financial Performance and KPIs

Source: RHP, Shadowfax Technologies Ltd

Key Risks and Concerns

Shadowfax has a track record of financial losses and volatile cash flows, with net losses of ₹1,426 million in FY2023 and ₹119 million in FY2024, despite achieving profitability in the six months ended September 2025. The company has also reported negative operating, investing, and financing cash flows in multiple periods, and continued expansion, technology spending, and international ambitions could keep profitability under pressure if revenue growth does not keep pace with rising costs.The business is highly dependent on its large and complex delivery network of over 4,200 touchpoints covering nearly 14,800 pin codes. Any operational disruptions such as system failures, infrastructure issues, or external events can directly impact service levels and costs, while underutilisation of expanded infrastructure could weigh on financial performance. In addition, revenue concentration remains a key risk, with nearly half of operating revenue in the first half of FY2026 coming from a single client and over 84 percent from the top ten clients, making the business sensitive to changes in a small number of large customer relationships.

Valuation