a. Core Brands- Includes stores of KFC, Pizza Hut, and Costa Coffee, which contributes 84% to the revenue in FY21.

b. International Business- Stores operated outside India comprising KFC and Pizza Hut stores in Nepal and Nigeria.

c. Other Business- Includes stores of their brands such as Vaango, Food Street, and many more.

Below is the breakup of Revenue from Operations:

Despite the pandemic, the company continued to expand the store and in the six-month ended March 31, 2021, they opened 109 stores in their core brands business. They are focusing on expanding the stores in high potential locations across towns and cities, airports, high street locations, malls, food courts, hospitals, business hubs, and transit areas.

Initially, the business started with a Pizza Hut store in Jaipur but subsequently, it expanded its operations in both KFC and Pizza Hut. It operates 264 KFC stores, 297 Pizza Hut stores, and 44 Costa Coffee stores in India, as of March 31, 2021.

Strengths:

Strengths:

a. Diversified presence: They operate the franchises of several highly recognized global QSR brands and are the largest franchisee of Yum Brands in India.

b. A major part of the revenue arrives from the core brand business operations.

c. The company has a flexible business model as management was able to adapt and navigate through a major change after covid.Weaknesses:

a. For the last two years, the company is making losses resulting in a negative EPS for the shareholders.

b. Pizza Hut and Costa Coffee have shown negative results on store-level performance with decreasing revenue on a YoY basis.

c. The company is incurring heavy operational expenses i.e. fixed costs.

d. It is also facing high competition from its peer companies i.e. Jubilant Foodworks who seems the leader in the industry.

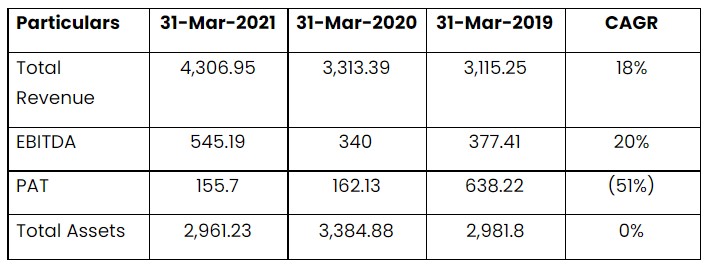

Financials: (₹ million)

Objects of the issue:

a. Repayment and/or prepayment of the company's borrowings fully or partially.

b. General corporate purposes.

IPO Details:

The promoter shareholding will reduce to 67.99% from 75.79% post issue.

2. Windlas Biotech:

About the company: Windlas Biotech Ltd was incorporated on February 19, 2001, in New Delhi. It is a B2B company engaged in pharmaceutical formulations which offer a range of CDMO services (Contract Development and Manufacturing Organizations) like product discovery, product development, licensing, and commercial manufacturing of generic products including complex generics. The company operates a manufacturing capacity at Dehradun.

Their business operates in 3 verticals:

a. CDMO products & services, which contributes 85% to the revenue in FY21.

b.Domestic trade generics & OTC market (nutraceutical and health supplement products)

c.Export

a. The complex generic products market faces a high barrier to entry as these products are generally difficult to develop and require special knowledge from the development and manufacturing perspective compared to conventional generic products.

b. The company has a very strong client base like Pfizer Ltd, Sanofi India Ltd, Cadila Healthcare Ltd, Emcure Pharmaceuticals Ltd, Eris Lifesciences Ltd, Intas Pharmaceuticals Ltd, and Systopic Laboratories Private Limited.

c. There are no listed companies in India that engage in a business similar to that of this company.

Financials: (₹ million)

Objects of the issue:

a. Purchase equipment required for capacity expansion for Dehradun Plant.

b. Finance working capital requirements.

c. Repayment/prepayment of the company's borrowings.

d. General corporate purposes.

IPO Details:

The promoter shareholding will reduce to 65.16% from 78% post issue.

3.Exxaro Tiles:

About the company:

Exxaro was incorporated on January 2, 2008. It is engaged in the manufacturing and marketing of vitrified tiles (ceramic tiles) used for floorings.

The products that the company manufactures are:

a.Double Charge Vitrified Tiles- Used in low to medium traffic areas such as airports, malls, offices, hotels, hospitals, etc.

b.Glazed Vitrified Tiles- Used in commercial and residential areas like corporate offices, homes, etc.They have a variety of 1000+ different designs of tiles in 6 sizes. Some of the well-established products of the company are the Topaz series, Galaxy series, and High Gloss series. It supplies its products to large infrastructure projects like residential, educational, commercial, hotels, hospitals, government, builders or developers, religious institutions, etc. It also exports tiles to different countries across the globe to Poland, Bosnia, USA, and others. Apart from vitrified products, the company focuses on adding ceramic wall products which have a high demand in the market. It generates 85% of its revenue from domestic retail and around 14% of total revenue is contributed from exports.

Currently, Exxaro Tiles has 2 state-of-the-art manufacturing facilities (modern and sophisticated manufacturing facilities) in Padra (Gujarat) and Talod (Gujarat) and has 6 display centres in 6 cities and 2 marketing offices in Delhi and Morbi (Gujarat).

Strengths:

a. The company has a strong international presence with exposure to 13+ countries across the globe.

b. Even after covid lockdown situations, the company faces huge demand for their products in the domestic market as well as in the global market.

Weakness:

a.The company’s total revenue and total asset growth seem to be stable.

b.Though the company has a strong presence in 13+ countries, it generates only 14% of its total revenue from exports.

Financials: (₹ million)

Objects of the issue:

Objects of the issue:

a. Repayment/prepayment of secured borrowings.

b. Finance working capital requirements.

c. General corporate purposes

IPO Details:

The promoter shareholding will reduce to 42.5% from 56.09% post issue.

4.Krsnaa Diagnostics Ltd:

About the company: Krsnaa Diagnostics was incorporated on December 22, 2010. The company provides a wide range of differentiated diagnostics services such as imaging (including radiology), pathology/clinical laboratory, and teleradiology services to public and private hospitals, medical colleges, and community health centres pan-India.

They have a large network of integrated diagnostic centres across India primarily in non-metro and lower-tier cities and towns with 1,823 diagnostic centres in 13 states across India as of June 30, 2021. It focuses on the public-private partnership (PPP) diagnostics segment and has the largest presence in the diagnostic PPP segment, according to the CRISIL report.

A public-private partnership is a long-term contract between a private party and a government entity where it combines the skills and resources of both, the public and private sectors through sharing of risks and responsibilities.

Strengths:

a.The major strength this company possesses is differentiated diagnostic services and a very strong network around 13 states across India.

b.The company experiences significant revenue growthFinancials: (₹ million)

a. Finance the costs incurred to establish diagnostics centres in other states across India.

b. Repayment/pre-payment of firm’s borrowings fully or partially.

c. General corporate purposes.

IPO Details:

The promoter shareholding will reduce to 27.38% from 31.62% post issue. I hope you have enjoyed this extensive blog on the key information about the upcoming 4 IPOs.

Strengths:

Strengths: