There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

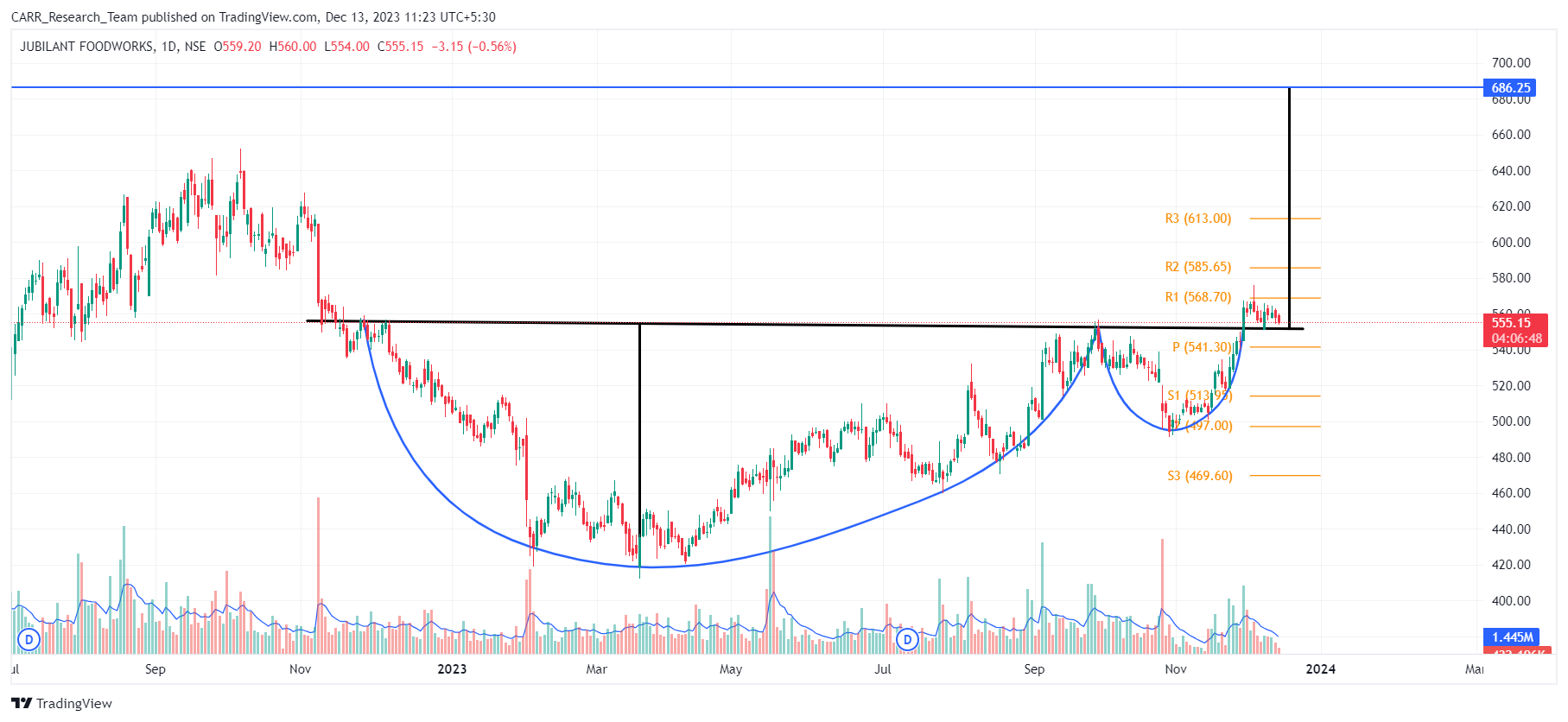

1. Stock name: Jubilant Foodworks Ltd.

Pattern: Cup and handle pattern and retest

Time frame: Daily

Observation:

During the period spanning November 2022 to November 2023, the stock maintained a sideways pattern, concurrently forming a cup and handle pattern on its daily chart. A breakout from this pattern is noted on November 29, 2023, accompanied by above-average trading volume, indicating a significant shift. The stock is presently undergoing a retest of the breakout level, with the Relative Strength Index (RSI) at a favourable level. As per technical analysis, a successful rebound from this retest, coupled with subsequent upward momentum, may propel the stock further upwards.

You may add this to your watch list to understand further price action.

Disclaimer: This analysis is purely for educational purpose and does not contain any recommendation. Please consult your financial advisor before taking any financial decision.

2. Stock name: Medplus Health Services Ltd.

Pattern: Head and shoulder pattern

Time frame: Daily

Observation:

Between November 2022 and August 2023, the stock displayed an upward trajectory, only to face a subsequent decline. Notably, from May to December 2023, the daily chart revealed the formation of a head and shoulder pattern. The stock experienced a breakout from this pattern on December 7, 2023, resulting in a downward shift. The Relative Strength Index (RSI) for the stock is presently at a low level. Technical analysis suggests that if the stock sustains its current momentum, it may see further downward movement in the foreseeable future.

You may add this to your watch list to understand further price action.

Disclaimer: This analysis is purely for educational purpose and does not contain any recommendation. Please consult your financial advisor before taking any financial decision.

-------------------------------------------------------

News for the day:

1) Jaguar Land Rover (JLR) is enhancing its partnership with Tata Communications for global digital transformation. Tata Communications will deploy cloud-first technology to connect all 128 JLR sites, improving supply chain efficiency and enabling AI-powered data analysis for enhanced production line performance. The collaboration aims to support JLR's next-generation vehicle production and advance its digital transformation strategy.

2) Shriram Finance is set to raise up to $500 million through international asset-backed securities (ABS), marking its debut in this funding model. The non-banking financial company (NBFC) plans to securitize a portion of its loan portfolio, with major global banks facilitating investor meetings in Hong Kong and Singapore for the transaction expected in mid-January 2024.

3) Sun Pharmaceutical Industries has increased its proposed purchase price for the complete acquisition of Taro Pharmaceutical Industries to USD 43 per share in cash, up from the initial USD 38 per share. The revised proposal has received in-principle agreement from Taro's special committee, with negotiations ongoing for definitive agreements, and the transaction is subject to further corporate approvals and customary conditions.