There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

About the Company

Incorporated in the year 1980, Valiant Laboratories Limited is an Active Pharmaceutical Ingredient / Bulk Drug manufacturing company having focus on manufacturing of Paracetamol.

Paracetamol (Scientific name: Acetaminophen or para-hydroxy acetanilide - C8H9NO2), is one of the most taken analgesic worldwide and is recommended as the first-line therapy in pain conditions by the World Health Organization (WHO). Paracetamol has several applications such as usage in treatment of headaches, muscle aches, arthritis, back aches, toothaches, cold and fever. The company manufactures Paracetamol in various grades such as IP/BP/EP/USP, as per the requirements of its customers.

The manufacturing facility of the company is located at Tarapur Industrial Area, Palghar, Maharashtra. The aggregate annual total installed capacity of the facility 9,000 MT per annum. Additionally, the company also has an in-house research and development unit within the same facility.

Industry Overview

The pharmaceutical API industry in India is ranked third-largest globally in terms of volume, behind China and Italy. About 35 per cent of API and intermediaries produced in India are exported and the remaining API and intermediaries are sold in the domestic market, including captive consumption by several large formulation players.

India is the largest provider of generic drugs, globally contributing to ~20% in global supply by volume of generics drugs.

The overall API industry in India grew from Rs. 781 billion in FY 2016-17 to Rs. 1,179 billion in FY 2021-22 registering a CAGR of 8.5% in rupee terms. Going forward the API industry is expected to clock a growth rate of 9-11% between FY 2021-22 and FY 2026-27, largely driven by growth in API exports, which is expected to deliver a healthy growth during the period under consideration.

The paracetamol API industry (Domestic consumption and exports) grew from Rs. 22 billion in FY 2016-17 to Rs. 39 billion in FY 2022-23. The paracetamol API market growth was mainly supported by growth in pain and analgesics therapy area which focuses on treatment of common fever, cough and cold as well as volume rise coupled with strong realization levels for players.

The paracetamol API demand saw uptick in FY 2021-22 owing to pent up demand, due to Covid-19 and extensive usage of common cold and fever drugs during the second wave of Covid-19. Also, the boost in export demand due to supply restrictions in China gave opportunities for Indian manufacturers to tap the potential export market. Going forward the paracetamol API industry is expected to clock a CAGR of 5-7% between FY 2022-23 and FY 2026-27, largely driven by the demand from domestic formulation manufacturers as well as export markets.

IPO Objectives

1. Investment in the wholly-owned subsidiary, Valiant Advanced Sciences Private Limited (VASPL) for part financing its capital expenditure requirements in relation to the setting up of a manufacturing facility for speciality chemicals (ketene and diketene derivatives products) at Saykha Industrial Area, Bharuch, Gujarat.

2. Investment in VASPL for funding its working capital requirements.

3. General corporate purposes.

Financials

The company's revenue saw a notable increase, rising from Rs. 182.37 crores in FY 2020-21 to Rs. 333.91 crores in FY 2022-23, reflecting a CAGR of 35.31%. Conversely, the EBITDA decreased, going from Rs. 50.00 crores in FY 2020-21 to Rs. 35.09 crores in FY 2022-23, accompanied by a decline in the EBITDA Margin from 27.42% in FY 2020-21 to 10.51% in FY 2022-23.

The Net Profit also experienced a decline, dropping from Rs. 30.59 crores in FY 2020-21 to Rs. 29.00 crores in FY 2022-23, and the Net Profit Margin decreased from 3.92% in FY 2020-21 to 1.64% in FY 2022-23. Furthermore, the company's ROCE and Return on Equity ROE both decreased significantly, falling from 70.86% and 48.10% in FY 2020-21 to 22.76% and 33.73% in FY 2022-23, respectively.

Valuation

The company's PE ratio stands at 15.71, while the industry's PE ratio is 44.50. This suggests that the company is undervalued when assessed based on the PE ratio. Additionally, the company's PB ratio is 4.55, whereas the industry's PB ratio is 22.31, further signalling undervaluation from a PB perspective as well.

Peer Comparison

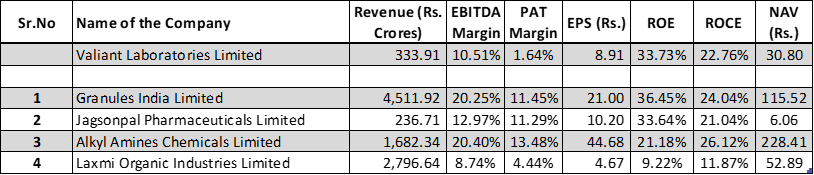

Granules India Limited and Alkyl Amines Chemicals Limited appear to hold prominent positions within the industry. Meanwhile, Valiant Laboratories appears to be on a similar footing when compared to its publicly traded counterparts.

Key Risks

1. The company manufactures only one product - the paracetamol API and therefore, any changes to the paracetamol API industry or the product demand will adversely affect the revenues, financials, and profitability of the company.

2. The company operates out of a single Manufacturing Facility located at Palghar, Maharashtra and therefore, any localized social unrest, natural disaster, or breakdown of services or any other natural disaster in and around Palghar, Maharashtra or any disruption in production at, or shutdown of, the manufacturing unit could have material adverse effect on the business and financial condition of the company.

3. The company is subject to strict quality requirements, regular inspections and audits by its customers and any failure to comply with quality standards may lead to cancellation of existing and future orders and could negatively impact the business, financial condition, results of operations of the company.

4. The Company, its Promoters and its Directors are party to certain legal proceedings. Any adverse outcome in such proceedings may have an adverse impact on the reputation, business, financial condition, results of operations and cash flows of the company.

IPO Details